Doc film humanizes the impact of Ethiopia’s China-backed industrialization

Chinese investment in Africa has been accelerating, and with it, questions about who benefits and who bears the cost. Across the continent, Chinese-backed factories are changing the landscape and the lives tethered to it.

In Ethiopia, rows of tomato fields that once stretched across Oromia were cleared between 2008 and 2012 to create space for factories within the Chinese-built and operated Eastern Industrial Zone. There, chimneys blast fumes into the sky — the sign of a new industrial order.

But what does it feel like to live in this new order, as opposed to reading about it in GDP indicators in flashy headlines?

Filmed over four years, the Made in Ethiopia documentary tells the story not through policy papers or trade statistics, but through the lives of three women caught in the churn of change: a farmer, a factory worker, and a Chinese manager.

“This is a story about complexity, lives lived in the shadows of big headlines,” according to Tamara Mariam Dawit, one of the producers of Made in Ethiopia.

In the first half of 2025 alone, China’s Belt and Road Initiative (BRI) engagements in Africa surged to US$39 billion, the highest of any global region.

According to the Green Finance & Development Centre, this included US$30.5 billion in construction contracts and US$8.5 billion in direct investments, with countries such as Nigeria, Tanzania, and Ethiopia emerging as key recipients.

The Made in Ethiopia film looks beyond these big numbers, attempting to capture the nuanced story unfolding on the ground. Viewers watch how the three main characters navigate the emotional and economic terrain of China’s industrial presence in Ethiopia.

Their experiences unfold inside Ethiopia’s flagship Eastern Industrial Zone, located about 40 kilometres south of Addis Ababa. The park is regarded as the blueprint for Ethiopia’s industrial park development.

The film is observational, slow, intimate and radically different from the sweeping, numbers-driven narratives often used to describe Africa’s industrial rise.

Ethiopia has been a poster child for Africa’s push into manufacturing. Its industrial zones, backed heavily by Chinese investment, promise job creation and economic diversification.

According to the Ethiopian Investment Commission, over 60% of Ethiopia’s operational foreign-owned manufacturing firms are Chinese-owned.

Tens of thousands of jobs have been created. But so too have frictions; over labour conditions, land acquisition, and the real cost of “progress.”

That’s where Made in Ethiopia intervenes. Instead of casting heroes or villains, it invites the viewer into lives rarely seen.

Workinesh, a farmer, is watching her land disappear; Beti, a young factory worker, is clinging to a fragile dream; and Motto, a Chinese production manager, is juggling expectations in a country that isn’t hers.

“We didn’t want to cast villains and victims,” Tamara explained in an interview. “There’s nuance in these relationships and too often, global media flattens that nuance.”

The nuance, in part, comes from how the film was made.

“They didn’t want a fixer,” Tamara said of directors Max Duncan and Zhang Zhenyan, who first approached her. “They wanted a collaborator. That kind of team-oriented mindset made a huge difference.”

Tamara, who was raised in Canada but has deep roots in Ethiopia’s film and development sectors, was no stranger to international productions. But Made in Ethiopia stood apart in its care-based approach and refusal to extract quick stories from communities.

The production team embedded itself in Dukem, sleeping in factory dorms and spending long months on location.

“You can’t expect magic with a 30-day shoot schedule,” Tamara says. “You have to wait — for trust, for relationships, for life to unfold.”

That patience yields moments rarely captured on camera: the fatigue in Beti’s routine, the weight behind Workinesh’s silence, and Motto’s managerial isolation’s quiet solitude.

And while the film is uniquely Ethiopian in setting, its emotional truths echo continent-wide.

From Nigeria’s Lekki Free Trade Zone to Kenya’s SGR railway, Chinese-financed infrastructure is reshaping African economies. Yet few narratives ask what this transformation feels like or who bears its costs.

“Too many documentaries look at Africa from the outside,” Tamara explained. “This one tries to start from within.”

For Tamara, who has produced a range of Ethiopian films and once worked in development with organisations like Save the Children and Plan International, accountability in storytelling is non-negotiable.

The film’s team is now fundraising for Roba, a child featured in the story whose mother hopes she’ll find a different future.

Viewers kept asking how they could help, and the filmmakers responded.

“In documentaries, especially from the Global North, there’s this idea that you shouldn’t intervene,” Tamara explains. “But real life is messier. You have to think about the people whose stories you’re telling. Supporting their livelihoods is the right thing to do.”

That ethic has also informed how the film is being screened. While Made in Ethiopia is making its rounds at international festivals, the team is prioritising university and community settings where discussions can go deeper.

The film had its Addis Ababa screening in the spring of 2025, attended by officials from both the Ethiopian and Chinese governments.

“No one comes out looking perfect, but no one is demonised either,” Tamara noted. “Everyone has room to improve.”

That balanced tone, along with its attention to human detail, is what sets the film apart.

It doesn’t ask who’s right or wrong. It asks: what does development feel like on the ground?

The stakes are real. Land. Dignity. Livelihoods. A future

“Development isn’t a straight line,” Tamara reflected. “It’s felt in bodies, in relationships, in everyday decisions. That’s what we wanted to show.”

This storytelling approach, rooted, collaborative, accountable, signals something deeper: a shift in how Africa’s stories are told and who gets to tell them.

The documentary filmmaking on the continent is waiting to actualize its potential and seeks internal funding. “Most of the money sits in Europe or North America,” Tamara noted. “And the people deciding what gets funded often don’t look like us. That changes the kinds of stories that get told.”

Still, she’s hopeful. Audiences are growing. Mobile access is increasing. And a new generation of African filmmakers is stepping forward with rich, layered, and grounded in care stories.

“We’re not just producing films,” she said. “We’re building a culture of accountability, collaboration, and storytelling that sees people, not just numbers.”

Made in Ethiopia is a mirror held up to a changing Ethiopia, to Africa, and to the world.

It reminds us that industrialisation is not just about foreign direct investment or factory output. It’s about people like Workinesh, Beti, and Motto, who are, in every sense, building for their country and building their own lives.

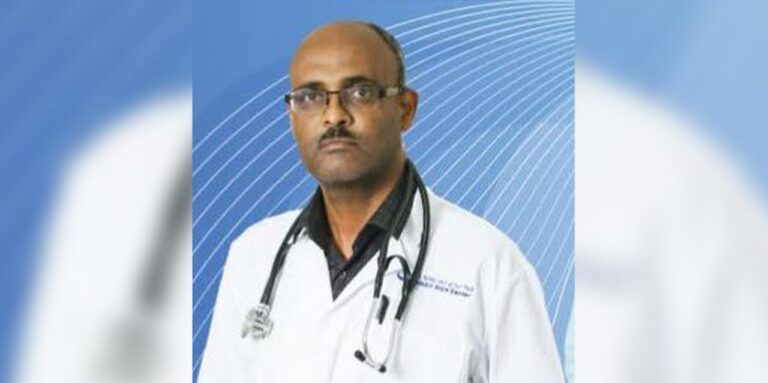

Name: Dr. SOLOMON DESALEGN

2. Education: (የት/ት ደረጃ) POST GRADUATE and SPECIALIST IN OBGyN

3. Company name: (የመስሪያ ቤቱ ስም) SEMAH MCH Center

4. Title: (የስራ ድርሻህ) PHYSICIAN AND MEDICAL DIRECTOR

5. Founded in: (መቼ ተመሰረተ) AUGUST, 2010

6. What it does: (ምንድነው የሚሰራው) GIVES MATERNAL AND CHILD HEALTH CARE SERVICES

7. Headquarters: (ዋና መስሪያ ቤት) ADDIS ABABA

8. Start-up capital: (በምን ያህል ገንዘብ ስራዉን ጀመርሽ/ክ) 70,000 BIRR

9. Current capital: (የአሁን ካፒታል) 30,000,000 BIRR

10. Number of employees: (የሰራተኞች ቁጥር) 90

11. Reason for starting the business: (ለስራው መጀመር ምክንያት) MY EDUCATIONAL BACKGROUND AND PERSONAL INTEREST IN THE FEILD

12. Biggest perk of ownership: (የባለቤትነት ጥቅም) TEAM WORK AND TAKING THE INITIATIVE

13. Biggest strength: (ጥንካሬህ/ሽ) PERSISTENCE AND DISCIPLINE

14. Biggest challenge: (ተግዳሮት) FINANCIAL MANAGEMENT

15. Plan: (እቅድ) FINALIZING MY EXPANSION HOSPITAL PROJECT

16. First career path: (የመጀመሪያ ስራ) MEDICAL DOCTOR

17. Most interested in meeting: (ማግኘት የምትፈልጊ/ገው ሰው) PM Dr. ABIY AHMED

18. Most admired person: (የምታደንቂ/ቀው ሰው) MY WIFE

19. Stress reducer: (ጭንቀትን የሚያቀልልሽ/ለህ) MY GOD

20. Favorite book: (የመፅሐፍ ምርጫ) None

21. Favorite pastime: (ማድረግ የሚያስደስትህ) SPENDING MY TIME WITH FAMILY

22. Favorite destination to travel to: (ከኢትዮጵያ ውጪ መሄድ የምትፈልጊ/ገዉ ስፍራ) GERMANY

23. Favorite automobile: (የመኪና ምርጫ) TOYOTA LAND CRIUSER