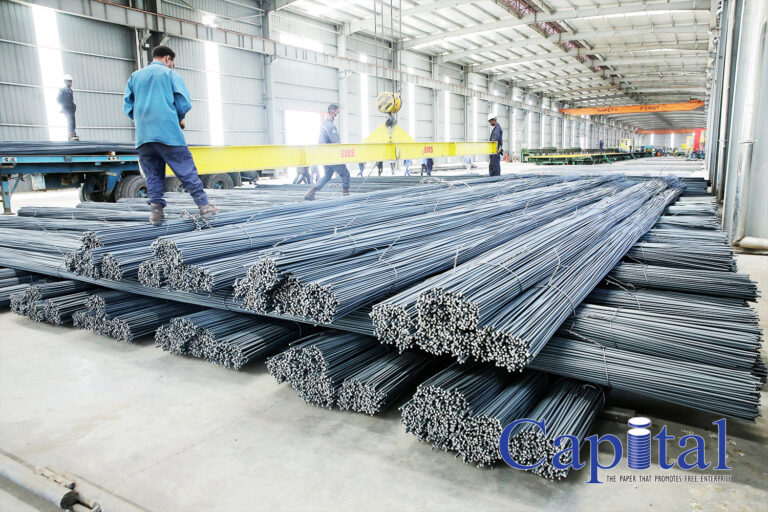

Sector actors in the steel industry claim that finished products are flowing into the country disguised as raw materials taking advantage of the duty free scheme under the cover for investment. The regulatory body has disclosed that it is taking the appropriate measures on the illegal actors.

It can be recalled that when the reformist government took power one of the measures it took was pausing the import of commodities under the cover of investment through duty free scheme.

However, experts who closely follow the steel industry and construction sector argue that despite such activities being halted as of about four years ago, the rebar and other steel products are now being imported in a duty free scheme under the cover for investment, “while significant portion of the commodity imported in duty free are injected into the market.”

They said that the behavior has been observed in the past few months but the trend has now expanded. Experts on the construction industry claimed that such products are sold without receipt, since it is illegally smuggled to the market, “it makes this difficult for contractors to get receipts for the product they buy.”

Besides that, the sector actors argued that the rebar contraband has picked up pace with its main channel stemming from the eastern part of the city.

“The other dangerous behavior that we have been informed of is that finished steel products are being imported under the document of billets or scrap,” they added.

They argued that illegal importers are using the changed harmonized code to import the finished construction materials, “This further affects the local industry besides bypassing the government import levy.”

“The import customs duty is almost minimal when importing raw materials, which is far from the case for finished goods. Thus, illegal importers are using improper documents to steal from customs duties,” experts explained.

They said that the illegal actors misguide government with regards to import of raw materials.

“Data may show that the volume of raw material import is very high since the harmonized code document shows it is the import of input for manufacturing industries, but in actual sense the commodities are finished and directly channeled to the market,” one of the sector actors elaborates.

As he described, such behavior creates false narrative on the sector development and expands the tax evasion.

“Currently steel industries are operating below one fifth of their capacity but the import and the foreign currency allocation goes for finished materials, contrabandists, and for those who abused the privilege the country facilitates,” he added.

They advised the government to be alert and stringent in mitigating this alarming issue.

Mule Abdissa, Chief of staff, Customs Commissioner Office, said that regarding the duty free scheme, the government has a strong stand, while special but rare permits are given by the relevant government body, which is the Ministry of Finance.

“In the past, the duty free privileges were significantly abused due to that the government doesn’t allow such kinds of mischief to happen again. However, some exceptional permits do exist,” he told Capital.

Regarding the contraband, he accepted that steel is one of the contraband commodities that the Commission is closely following.

Tegene Derese, Intelligence and Contraband Follow up at Customs Commission, recalled that contraband is damaging the country’s economy and affects the hard currency earnings and to this end government has drawn a line through which the higher body is tackling the issue.

He added in collaboration with relevant bodies the Commission has achieved significant performance in the ended budget year, “but the impact is still there.”

He said that misbehavior to import finished goods under raw material documents is being seized and some others are under investigation.

“The case is not only aligned to steel,” Tegene told Capital.

He insists that those who have information are supposed to share with the commission since it takes concerted efforts to capture the culprits.

Steel, rebar importers bend law to evade tax

WorldVeg holds consultative workshop on bio-pesticide adoption

World Vegetable Center Ethiopia held a consultative workshop on bio-pesticide regulation on August 9, 2022, with participants from both private and government sides engaging in the workshop discussing on policy gaps and bottlenecks in production, introduction and application of bio-pesticides as an IPM component.

“Even though through time we are seeing changes in the agriculture sector, yet the vegetable sector is backward than others, one of the problems is finding eco friendly bio pesticides,” said Webetu Bihon, country representative of World Vegetable Center to Ethiopia, indicating that introducing and promoting the production of local eco-friendly pesticides using local plants as a mandatory solution.

“Few have been formally recommended pesticides and the ones being used in Ethiopia are imports from Kenya and Holland,” Webetu explained.

As indicated on the session, Bio- led management of pests’ coverage is also small but gradually increasing in the ornamental sector.

“Provided they are applied correctly, bio-pesticides can provide excellent control of pests and have a host of other positive attributes that surely make them the weapons of choice for the future sustainable pest control; it also has a potential to expand greatly as products are improved and better methods for using them in IPM systems are developed,” the county representative underlined.

As pest’s importance will increase with the current and the future state of agriculture in Ethiopia, the session recommended public institutions, donors, NGOs, actors to support the ways and means of commercialization and use of bio-pesticides and also to place policy, regulations, directives development and implementation that promotes bio-pesticides and minimizes the use of synthetic pesticides.

AFRICAN SOLUTIONS TO AFRICAN PROBLEMS: REBOOT RESTART RESET

A typical treatment for technological devices in need of repair, from smart phones to computers, is a reboot. This usually resets the operating system, allowing for restart that sometimes means erasing and restoring the device’s operating system to original factory settings. Once reset, new apps and programs may be re-installed, as needed. This little refresher in tech serves as the perfect analogy for African solutions to African problems. Africa has not been alone in coping with plethora of problems related to Covid19, in particular education and the economy. Ethiopia, Africa in general, are on a development trajectory, guided by the aspirations of the African Union’s Agenda 2063, where education is key. The AU notes that Africa will advance with “…well educated citizens and skills revolution underpinned by Science, Technology and Innovation…”. Per usual, governments alone cannot and should not be expected to design and implement curricula and “revolutionary” advancements in a vacuum. In Education Law, Strategic Policy and Sustainable Development in Africa Michael Addaney writes, “The future of Africa is too important to be left to the African Union (AU) and national governments alone. On realizing Agenda 2063 in Africa, the chapter draws attention for the need to make conscious effort to ensure that the ordinary people and national-level public and private institutions own the process of creating the Africa we want. To achieve this …Agenda 2063 (needs) to be integrated into the existing educational system. … education-development nexus (is needed to) achieve radical transformation as envisaged in the Agenda, education is the golden key.”

Let the reset begin or resume. The Association of African Universities North America (AAU), inaugurated as a Diaspora initiative at the AU Mission in Washington DC October 2019, will host the World Conference on Education and Restitution. The hybrid event to be held in Accra, Ghana 30 August to 1 September, is themed “The Past The Present and the Future – Afrofuturism And Africa’s Development.” The three major topics are Re-Thinking Education: Towards Achieving African Renaissance; Reclaiming and Reconceptualizing African Arts, Culture and Heritage and Addressing the Pre-Requisites for the Implementation of the Africa Continental Free Trade Area (ACFTA). AAU states, “The overall aim is to reclaim and recontextualize Africana education, technology, politics, languages, histories, arts, culture, music, and spirituality toward a conscious effort of unification and rapid development of Africa.” Leading Africans in academia, the arts, sciences and technology will be hosted by the Ghana AAU Secretariat in collaboration with Pan African Heritage Museum and UNESCO.

The AAU is an international NGO founded in Rabat Morocco, 12 November 1967 with 34 public universities, now over 320 and counting. In addition to promoting academic exchange for staff and students, AAU’s diverse Pan African continental membership assures enrichment of curricula and approach to higher education through “major language and educational traditions”, essential for African driven pedagogy. It is important to note AAU’s instrumental role in mitigating disruptions caused by the COVID-19 pandemic in higher education. The majority of African universities had no academic contingencies for such an unexpected world-wide pandemic. In partnership with Sister organizations in Africa, AAU provided capacity-building workshops in online teaching and learning methods; conducted three months of training sessions, training over three hundred faculty and provided over five hundred African faculty and graduate students with online training in Research methods. This is an example of African solutions to African problems, resetting colonial pedagogies with the expertise of Africans at home and abroad.

Another aspect of the African ‘self-help’ Agenda 2063 includes ‘transforming African economies to sustainable and inclusive… through diversification and resilience.’ At the root of Africa’s problems, such as discontent leading to uprisings, are economic issues including access and opportunities for youth. And while many African millennials are curating their way out of poverty, not waiting on the status quo; inventing new technologies, products and services, other youth succumb to manipulation and miseducation, fueled by twisted narratives lacking in analysis. Ironically, this disrupts the very supply and value chain they wish to be beneficiaries of, sadly. Solutions stand primarily with Africa and her Diaspora. The Government of Barbados and the African Export Import Bank (Afreximbank) will host the first African Caribbean Trade Investment Forum 2022 (ACTIF2022) 31 August to 3 September. Hosted under the theme “One People, One Destiny: Uniting and Reimagining Our Future” the goals of the Forum are to “…foster the development of strategic partnerships between the business communities in Africa and the Caribbean Community (CARICOM) region, to bolster bilateral cooperation and increase engagement in trade, investment, technology transfer, innovation, tourism, culture, and other sectors. …contribut(ing) to the implementation of the African Continental Free Trade Agreement (AfCFTA) and the Caribbean trade development agenda…reflecting the deep-rooted ties between Africa and the Caribbean based on their shared history, culture, common identity, and destiny.”

ACTIF2022 participants include African and Caribbean Heads of State, senior government officials, business leaders, business associations representatives, development agencies, multilateral finance institutions, think-tanks and research institutions from Africa and the Caribbean. Realizing that even continental initiatives can be best realized with African Diaspora, the future of Africa continues to be bright. According to the old saying, “It is always darkest before the dawn…”. So, as we sit watching the animated circle, taking forever to load, waiting for the light of the reboot, we remain confident that problems faced will be remedied with an African reset that wipes out corrupted files. A proper reboot to reset our operating system, free of malware, viruses, spyware and any harmful software and hardware.

Dr. Desta Meghoo is a Jamaican born Creative Consultant, Curator and cultural promoter based in Ethiopia since 2005. She also serves as Liaison to the AU for the Ghana based, Diaspora African Forum.