To those seriously interested in the whole spectrum of human affairs, (not excluding our interaction with ‘Mother Nature’) the current systemic/structural crises have become truly frightening. Unsafe imbalances tend to dominate the operations of the various global institutions. Many of the interactions in the various sectors of collective human existence; politics, economics, etc., are not only superficial and fake, but are also precariously fragile. The economic domain of the world order, which anchors all other institutions, (more or less) is unstable. The slightest perturbation within this dominant sector is bound to cause major disruptions across the world. Unfortunately and like before, (the 2008 financial crisis, etc.) the global sheeple (human mass) is intentionally misled about the prevailing concrete reality. Instead of facts and the bitter truth, the sheeple is fed lies, lies and statistics. Frivolous news and numbing entertainment are aggressively used to detract the global masses from important issues!

As we never tire of repeating, the global economy, which is fixated on continuous growth, is an epitome of stupidity. Further exasperating the situation brought about by this nonsense is the monetary system that underpins the global economic regime. Whichever way one cuts it, modern finance is built on massive fraud and it is this fraudulent activity that is accelerating the demise of the world system! Like many things in life, the current crises of modern finance emanate from internal as well as external challenges. The continuous printing of money out of thin air has distorted the very rule of the game. Those connected to the money spigot become immensely rich, (way beyond compensatory rewards for their efforts), while the working stiffs continue to lose ground. The lopsided income distribution, particularly since the 2008 financial crisis, is a very clear example of what finance is capable of doing. If truth be told, modern finance has single handedly redefined what capitalism is all about.. Understandably, the Davos crowd is now very worried. These operators know that the whole scheme is a scam, and without this con game most of their supposed wealth (unearned) will just vanish into thin air, whence it came! At the end of the day, real wealth is derived, directly or indirectly, from the systemic disfranchising of the global sheeple’s labor. The Davos bunches are masters at cleverly employing various manipulative technics to have their ways. Wrongly educating the masses as well as their minions to unquestioningly accept the status quo, hence their own subjugation is one such scheme.

The other agenda item in the Davos jamboree is how to save global finance from ascending informatics. The onslaught brought about by modern informatics in finance, particularly in the area of currency is scaring bankers and the central banking system. The two evils existing banking/financial system depend on, namely; hierarchical centralization and non-transparency, are being challenged by the emerging crypto currencies! All cryptos, almost without exception, (exceptions are those being concocted by the banksters/states) are working to get rid of these two evils of the prevailing global financial regime. Again, this moves is scaring the daylight out of the manipulative cliques, at the service of monopoly capital. Naturally many of the global states are genuinely confused about cryptos and where they are heading. On one hand, those who have not been profiting immensely from the current arrangement (peripheral countries) want financial regime change. On the other hand, the core countries want to maintain their hold of the system to that they can continue to milk the poor in their countries as well as abroad. What would ultimately prevail in the long run is anybody’s guess. To be sure, there are many problems and difficulties associated with cryptos that need to be solved before cryptos become fully useable. Some states are meticulously working to come up with cryptos that will help change the existing fraudulent banking system!

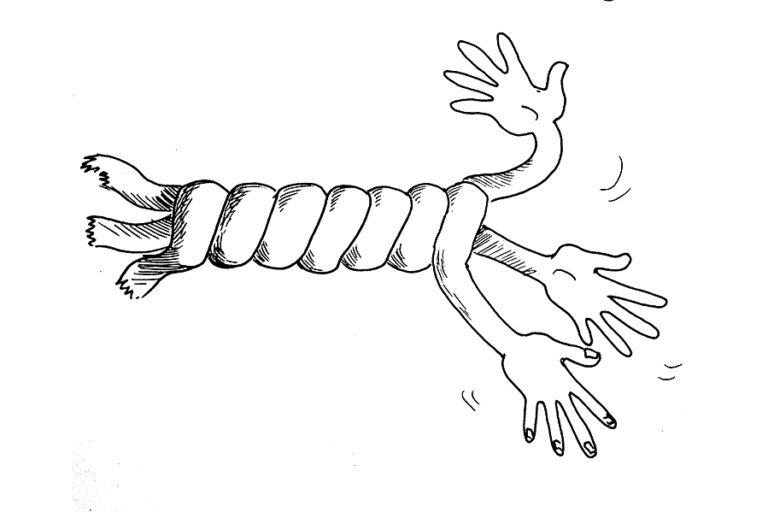

In the mean time the global sheeple is becoming angrier by the day, hence ‘populism.’ If things don’t improve significantly and soon, what follows might well be interactions involving pitchforks, guillotines and machetes! In fact, one of the major agenda item in Davos is how to deal with the rising ‘populism’ worldwide. Davosians have figured out that ‘populism’ will pose serious challenges to their ongoing accumulation process. ‘Populism’, whether of the right or left inclination, might not tolerate the current polarized existence. Various initiatives to seriously undermine the reigning economic regime is already underway by forward articulators and activists. Alarming resource shortages and visible environmental degradation cannot inspire long term confidence in the system, however much one is brainwashed. The ‘knowledgeable’ elites, particularly those who have major stakes in the global status quo, have chosen to be part of the problem instead of trying to become part of the solution. Sadly, the large majority of the learned is sufficiently brainwashed by establishment institutions, (including the paid and state media) to be of much help in devising needed alternatives.

Foundational crisis

Ethiopia earns $3.6 billion in revenue from export

Ethiopia has earned 3.6 billion US dollars from export of different commodities during the concluded 2020/2021 fiscal year, the Trade and Industry Ministry announced.

In the past budget year, the country earned 592 million US dollars more, showing over 19 percent increase from revenue registered in the same period of the previous year.

Ethiopia’s export mainly depends on agricultural products with coffee and flower contributing 25 and 13 percent respectively to the total export value.

He also underscored the need to shift to manufacturing, which is contributing only 6.8 percent to GDP.

Agriculture, manufacturing and mines contributed 2.47 billion (68%), 390 million (11%) and 668 million USD (18%) respectively to the total earning. 93 Million USD (3%) is earned from export of electricity and electronics materials.

From the total export Coffee earned 25%, Gold 19%, Flower 13%, Khat 11%, Oil seeds 9% and grains account for 6% with a total value of 3 billion USD.

Cement prices shrink by half as MOTI opens market

The decision of Ministry of Trade and Industry (MoTI) to opening up the cement market to the previous scheme has slashed the price by half.

Experts in the sector said that the price of cement per quintal has sharply dropped this week following the government’s allowance of buyers to access the construction material directly from manufacturers.

Builders that Capital spoke to regarding the latest development on the industry said that the market has tremendously calmed down just few days after the decision of MoTI.

“Not only has the price shrunk but the product is now also easily available in the market, which helps us to accelerate our construction projects,” one of a real estate developer told Capital.

“In the past the price of a quintal of cement at the factory was less than 300 birr but actually we bought it from black market up to 800 birr,” he said.

He added that it has had an effect on their business since the transaction is undertaken in illegal ways at the black market with the receipt they issued by about 300 birr for sellers but actually paid 800 birr.

According to sources, currently the price of cement has dropped about to 400 birr per quintal at the factory rate.

“This time both builders and the government shall benefit since we get the product on the stated amount from legal market with the receipt of the stated amount of money due to that the government shall also get its appropriate revenue from the tax that was calculated on the stated amount, while the shadow traders are losing their place,” a builder commented.

Experts added that such market price will also encourage factories to produce the day and night since it is better profit for them, “this situation may also attract others to invest on the sector.”

Experts claimed that illegal chain was started from factories down to retailers that were revoked by the market itself.

On its statement last week, MoTI said that it has decided to make cement supply and distribution in accordance with the previous marketing guidelines.

“In order to address grievances in the cement market, the government’s efforts to improve the accessibility of cement products were carried out under the previous marketing system. As a result of an agreement to do so, and the capacity of factories to fill the supply gap, and the government’s decision to import cement as needed, the marketing directive was suspended indefinitely,” says Kassahun Mulat, Director of Commodity Pricing, Monitoring and Control, Cement. Kassahun has decided to conduct the transaction in accordance with the free market system as the previous directive and enforcement circuits have been repealed.

In the past the government had set a factory production price for the 12 listed cement factories ranging between 233 birr and 300 birr to control the illegal brokers. But in actual term the problem was not solved.

Some experts like Gemechu Waktola, Assistant Professor at Addis Ababa University and Founder and CEO at The i-Capital Africa Institute that organizes the East Africa Cement, Concrete and Energy Summit, explained that the government should leave the sector market for players rather than involve itself.

“When the government imposes conditions on market, the problem becomes larger rather than a solid solution. As the experience of other countries, the market of cement, which is the second consumable product after water, shall be managed by a strong association established by sector actors,” Gemechu commented.

Tycoons back National Defense Forces

The manufacturing moguls back the National Defense Force with two hundred million birr in a single meeting, Capital learnt.

On the meeting chaired by Janitrar Abay, Deputy Mayor of Addis Ababa City Administration, held on Thursday July 22 at Sheraton Addis, well known Ethiopian investors were involved particularly on the manufacturing industry have vowed almost 200 million birr to support the law enforcement mission at the northern part of Ethiopia.

Sources who attended the meeting told Capital that the meeting was accompanied by full of allure opinion and sensational mood.

On the meeting investors promised that they will continue to support the government’s effort to cut the current challenge that the country faces in northern Ethiopia. The law enforcement measure was commenced when the outlawed and former central government political dominant TPLF ignited firing onto the northern command of Ethiopian National Defense Force (ENDF) late November 3.

One of the participants stated the meeting was very emotional.

Sources said that prominent business leaders including Sheik Mohammed Hussein Al-Amoudi, Sabir Argaw, Getu Gelete, Belayneh Kinde, Buzayehu Tadele and others have pledged millions of birr to support the mission.

“They pledged huge amounts of money happily,” one of the businessman who attended the meeting told Capital, “I, myself have contributed millions of birr. It is national issue.”

“We have contributed this sum because everything shall run smoothly if the country is peaceful. We will continue our contribution for our country,” another manufacturer told Capital.

Some of the investors have contributed 10 and more in millions of birr at the initial stage while on the day the contribution of Sheik Mohammed Hussein Al-Amoudi was very big as he contributed 100 million birr.

Sources said that the initiative will continue on other sectors and may have another round call to support the nation to prevail its peace.

It was recalled that recently Lieutenant General Bacha Debele, one of the top leaders of the mission, and Adanech Abiebie, Deputy Mayor of Addis Ababa City Administration, met with Ethiopian investors from different sector to brief them about the recent central government decision that took unilateral cease fire to open space for farmers in Tigray region to manage their harvest in this rainy season and to smooth humanitarian operation.