Runners up spot at the end of the premier league season, Ethiopia Bunna booked a place at next year’s CAF Cup qualifications. Wolkite Ketema’s brief stay at the top tier ended in misery.

Two years into his four years contract Head Coach Kassaye Arage helped his side to finish second in the table with fourteen points behind champions Fasil Ketema thus a place in next year’s African Confederation Cup.

Although luck of consistency and defensive blunder turned out a major problem throughout the season, thanks to loan striker Abubaker Naser’s incredible effort Bunna managed to secure the runner up spot ahead of historic rival St George with equal points but in goal differences. Finishing second without any foreign player in the squad is what the biggest credit is for the club as well as Kassaye.

The only other side with no foreign footballer Wolkite Ketema followed Jimma AbaJifar and Adama Ketema into relegation. With Coach Degarege Yizaw running away from the battle front due to a medical case and a new boss Sisay Abreha taking the reign, Wolkite hardly came functional, collecting just a mere 23 points from 22 matches.

Though Wolkite was mid-table with 16 points from four wins and four draws at the end of the mid-season break, things turned sour in the second round bagging only six points from a single win and three draws. Ardent Wolkite supporters disclosed that no one from the club officials is willing to give clarification why their team bottled out of the top league despite a readymade financial support is at hand.

Bunna, finishing runner up with no one foreign footballers in the squad is a big achievement. Ethiopia Bunna is the only side next to Wolkite Ketema with no foreign footballer in the squad.

Though it is mission accomplished to Kassaye who promised to at least finish runner up in his second season with the club, the major coup is that of dominating the season without any foreign players. Considering relegated sides that boast five or four foreign imports like Adama and AbaJifar respectively, Ethiopia Bunna disproved deserves a huge appreciation relegated finishing bottom of the table.

Ethiopia Bunna secures Confederation Cup while Wolkite faces relegation

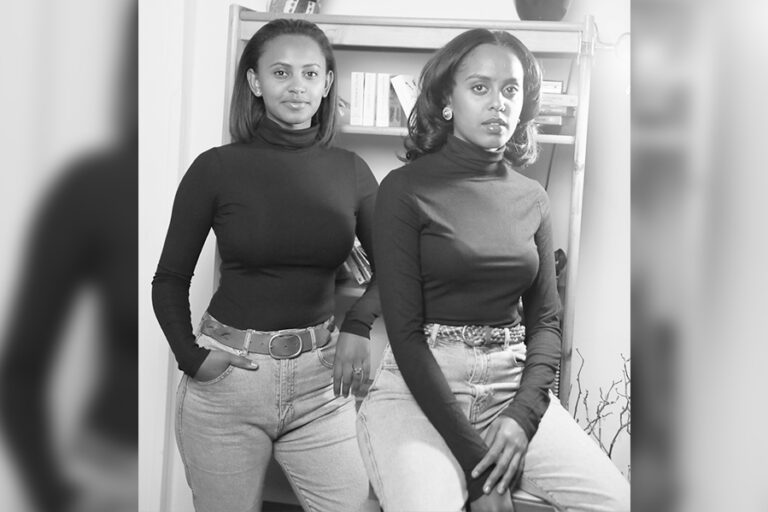

Feven and Rahwa G/meskel

Name: Feven and Rahwa G/meskel

Education: Masters in Marketing Management – both

Company name: WAWI and UNBOX

Title: Co-founders

Founded in: WAWI – 2018.UNBOX – 2020

What it does: WAWI – fashion products, UNBOX helps brands to grow

HQ: Marteresa Building, around Meskel Flower hotel

Number of employees: 8 permanent

Startup Capital: 100,000 birr

Current capital: Growing

Reasons for starting the business: To fill the gap in the sector

Biggest perk of ownership: WAWI: The launch of our first fashion collection in 2018.

UNBOX: Signing up three of our biggest clients

Biggest strength: Ability to consider and balance strategic issues

Biggest challenging: Design and creative work tends to be undervalued in Ethiopia

First career: Rahwa – Brand Manager at Heineken Ethiopia.

Feven – Deputy General Manager at Edra Printing Technology.

Most interested in meeting: The Obamas

Most admired person: Rahwa: Patrick Bet-David

Feven: Vusi Thebekwayo

Stress reducer: Nature. Sometimes, a cold white wine helps too

Favorite book: Rahwa: Blue Ocean strategy

Feven: Outliers

Favorite destination: Rahwa: Amsterdam

Feven: Johannesburg

Favorite automobile: Land Rover Defender

Why to Consider Rebranding?

By Aschalew Tamiru

I am writing articles on branding related issues on the weekly capital. Misconception about Branding, Basics to Successful Branding, Why Do Brands Matter, Can anything be Branded, How to Organize your Brands, Which Type of Logo Fits your business and How to Organize your Brands are among others.

In this, Why to consider Rebranding, article the reasons for rebranding with the accompanied pictorial examples will be discussing in brief.

Rebranding is the process of changing the corporate image of an organisation. It is a branding and market strategy of giving a new name, symbol, or change in design for an already-established brand. The idea behind rebranding is to create a different identity for a brand, from its competitors, in the market and make the new image more attractive to customers and to the public in general. Rebranding is conducted with an existing brand.

Rebranding involves changing or modifying elements of a brand. Rebranding occurs when a company decides to change a significant element of the brand. Such a change could be obvious like a new brand name or logo, or it might be slighter such as a slight shift in messaging to better communicate a more relevant brand promise.

It is worth mentioning some of the elements of a brand whereby rebranding is conducted on. The below are the brand elements that make up a brand, with their accompanied brief meanings that are cited by most brand scholars.

Logo: as I have also mentioned it in my previous articles, a logo might be a name, term, symbol, mark, sign, etc. that represents a company, a product, or an idea.

Corporate colours encompass primary colours, secondary colours and supporting colours, a company is identified with and they are using by a company consistently as indicated in the branding guideline of the company.

Typefaces – font type what the company is applying every time for its written communication.

Tagline or motto: a tagline, also known a slogan or motto, is a phrase that accompanies the brand name of the company to quickly translate the positioning and brand statements into a few memorable words that provide an indication of the brand offerings, promise, and market position. Examples of local and international companies’ tagline- always one-step ahead, it’s time for Africa, think different, just do it.

Corporate communication:

design and standardization of general template for corporate letter heads, envelops, inter-office memos, business cards, stamp, E-mail signature, identity cards, fax, etc.

Promotional items-design and standardization of branded giveaways that the company uses to promote itself and its products as well; this includes pen, pencil, T-shirts, cap, umbrella, key holders, mug, sunshade, vas, wall watch, car decal (bolo sticker), flash disc, mouse pad, car mobile charger, watch, and the likes.

Administrative papers: layout design and standardization of templates for all administrative forms used by the company’s staff and customers. This includes designing of different formats, if commercial banks are taken as an example; deposit and withdrawal slips, account opening formats, and saving accounts passbooks, cheque, transfer request forms; loan application formats are among other.

Communication signage:

design and standardization of internal and exterior signage and wall branding that the company would use for outdoor advertising.

Website: designing of a website, portal so as to make the company refreshed, friendly and informative, in order to promote visual identities online.

Presentation template:

designing of a general template for PowerPoint presentation to be used in the company including PowerPoint intro, master grid, slides for inspiration/layout and design presentation.

Photography: the photography that the company uses for different communication (ranging from advertising to website). This includes people photography, products photography, choice of colours in photos, cropping choice of themes, and the likes.

Events: this is designs for material that are used by the company for various events such as exhibition materials, podium front, and the likes. Besides, the company may include and create other elements of the brand which are believed relevant by the company.

A company creates the physical elements for the aforementioned components that make up the brand and could consider other elements depending on the peculiar nature of the company.

Most branding scholars acclaim that rebranding can breathe new life into businesses and keep them from being overshadowed by the competition. Branding scholars mention the under listed reasons for why companies go for rebranding.

Keeping up appearances: Basic elements of branding go in and out of fashion. Typeface, colours, images and logos can become dated. To keep up with the marketplace and contemporary styles. Want a company to look fresh and new then the company considers a makeover that is rebranding.

Predicted Growth: When a company is preparing for expected growth, particularly international growth, it might rebrand products and services into a consolidated brand. This is often done for consistency and to save money over time. This type of rebranding is also done when a company simply needs to create a greater sense of brand unity across its business.

Repositioning. As a company matures, it grows in the marketplace, evolves over time and may be something much different from what it was when it first began. The original identity could become more of a liability and hold the company back. As most rebranding research findings depict, this is the main reason for companies to execute rebranding. If the look and feel of the brand is old, it is time for companies to be rebranded.

New Line of Business or Market: When a company enters into a new line of business or market that is not cohesive to the existing brand identity, a rebranding might be in order. As indicated on various branding articles as an example, Apple was first known as Apple Computer. As the company evolved into new lines of business beyond computers, the original brand name was too restrictive. With a simple slice to the additional word in the brand name, the brand was ready for new growth and opportunities.

New Target Market: When a company wants to appeal to a new target market, a rebranding might be necessary. There are times; the rebranding might not require an actual name or logo change, a minor modification or change on some of the brand elements would be made in such a way that it would fit the new target market. One article written about the renowned fast food company, McDonald’s, referring to itself as MickeyD’s in commercials to target a different demographic from its traditional family target market.

Relevancy: When a company realizes its brand is losing relevancy in customers’ minds, it might be time to rebrand.

Customer-centricity: The speed of business today is incredibly fast paced. Customers behaviour and need change and progresses. The brand has to keep up to remain customer-focused and relevant. As technology advances, customer retention will be challenging. A new brand grabs attention and gets a company noticed by the target market and the public at large.

Leadership change: Brands are commonly linked to company leaders. When the founder departs, a new CEO comes in or a company is handed down from one generation to another, the company starts transitioning overall. This is a good time to consider a new identity to reflect this shift. This is also widely observed in our country too.

Merger or Acquisition: When companies merge or acquire other companies (and even when they break apart), rebranding are often required. These types of rebranding are very common around the globe and often go through multiple iterations. In Ethiopia, some years before Construction and Business Bank (CBB) has acquired by Commercial Bank of Ethiopia and the brand of CBB is no more existed now. Rebranding helps provide a new visual identity, especially if there are overlaps in customers, geography or products.

Legal Issues: There are a number of different legal issues that could cause a company to rebrand. Trademarks are often at the root of these rebranding examples. That is why it is so important to conduct an exhaustive trademark search and obtain the trademark rights to a company’s brand name before it goes to launch it. In association to legal issues, some companies in Ethiopia are also forced to change their brand identity and rebranding their companies name.

Competitive Influences: Sometimes competitor’s activities can be the means to a rebranding. When a competitor renders a company’s brand useless or dated, a rebranding could help the company to regain a foothold in its market.

Negative Publicity: In the business world, nothing always goes right. Problems may happen for big and small companies. Negative words of mouth and negative publicity is among the problems that may result in rebranding of the company.

The instinct to rebrand is understandable now; however, there is a difference between an old logo and an outdated logo. Branding scholars advice that if a company has a well-established brand, it’s best to do solid audience research before throwing the old one out.

Various articles and books written on branding are used as references.

Aschalew Tamiru was a full time lecturer at various universities, currently he is working with Dashen Bank.

Aschalew holds MA in Marketing Management from Addis Ababa University. He is a writer of Make a Difference with Customer Service book and a certified Management Consultant. He can be reached by aschalewt21@gmail.com.

Professor Mitiku bestowed with “Officier de l’Ordre de la Couronne”

The Embassy of Belgium in Addis Ababa organized a ceremony to pay tribute to the late Professor Mitiku Belachew in presence of his wife, Fatima Chatar Belachew, members of his family and friends of the Rotary Club on Wednesday May 26.

During the ceremony Ambassador of Belgium to Ethiopia François Dumont hand over to Professor Mitiku Belachaw’s wife the Belgian distinction of “Officier de l’Ordre de la Couronne” ( Officer of the order of the Crown) , recently bestowed upon him for his exceptional merits and his exceptional career as surgeon.

The Ambassador said “this decoration is awarded to your husband to honor the exceptional merits of his professional career as a surgeon but also symbolizes the friendship between Ethiopia and Belgium.”

Professor Mitiku Belachew passed away on the 7th of April 2021. In March, he had had the opportunity to receive the diploma of the Belgian decoration and the congratulations of the Belgian Deputy Prime Minister and Minister of Foreign Affairs, Sophie Wilmès. He had welcomed with simplicity the “good news” and he was planning to receive the decoration on the occasion of his next stay in Ethiopia.

Born on the 11 of June 1942 in Wonchi, he moved to Addis at the age of 12. Experiencing the death of his brother, he studied medicine at Addis Ababa University to understand the causes of his brother’s death. Then with a scholarship, he moved to Liège University in Belgium, although he did not speak French. He graduated in 1970. He took the Belgian nationality but Ethiopia was always very deep in his heart. He worked in Liège as a surgeon and invented a laparoscopic adjustable gastric banding to help people suffering from obesity. He performed the 1rst successful surgery of the sort in 1993 using a laparoscopic camera.

The “High mountain Shepherd who became surgeon” the title of his autobiography recently translated to Amharic, was very well known in Belgium. In Belgium, he was considered in a famous radio show as one of the most prominent personalities among the “Belgians living abroad or from foreign origin”.

According to the Belgian Ambassador “What struck me when I met him last year in Addis Ababa, was his willingness to transmit a message of hope and positive ambition to the young generations, to his son Shibeshih, to his grandson Ulysses but beyond to the Ethiopian youth. Believe in your dreams. Be ambitious for you but also at the service of your own community. “Dignity for me and for all the others” was his motto.”

Professor Mitiku visited Ethiopia regularly to support various development projects in Wonchi and helping hospitals as well