South Africa jazz trombonist and composer Jonas Gwangwa, whose music powered the anti-apartheid struggle, died aged 83 on January 23.

South Africa President Cyril Ramaphosa led the tributes to the legendary musician who was nominated for an Oscar for the theme song of the 1987 film “Cry Freedom.”

“A giant of our revolutionary cultural movement and our democratic creative industries has been called to rest,” Ramaphosa said.

“The trombone that boomed with boldness and bravery, and equally warmed our hearts with mellow melody has lost its life force” the president added.

There were no immediate details on how or where Gwangwa died.

He passed away on the third anniversary of the death of the “father of South African jazz” Hugh Masekela and the second anniversary of the death of Zimbabwean musical legend Oliver Mtukudzi. January 23 had become “the day the music died,” the South African and other media outlets said.

Gwangwa was born in October 1937 in Soweto and went on to have a career spanning 40 years.

“He delighted audiences in Sophiatown until it became illegal for black people to congregate and South African musicians were jailed merely for practicing their craft,” the presidency’s statement said.

He was awarded the Order of Ikhamanga, South Africa’s highest national award presented for achievements in art and culture, in 2010.

The award recognized his work as composer, arranger and musical director of the Amandla Cultural Ensemble, a cultural group formed by activists from the African National Congress in the 1970s.

South African Jazz ‘Giant’ Jonas Gwangwa Dies Aged 83

AMBASSADORS OF SCIENCE

In the recently concluded Virtual Edition of Next Einstein Forum held in Kigali Rwanda, NEF Ambassadors ‘class of 2019-2021’ was unveiled. NEF Ambassadors are the NEF’s young science and technology champions, one from each African country. All under 42 years, they drive the NEF’s local public engagement activities while growing their careers through the NEF’s partnerships that offer opportunities for mentorship and collaborations with established researchers.

Among these is a budding Ethiopian scientist, Andebet Gedamu who was distinguished and recognized by Africa’s biggest scientific gathering.

Andebet Gedamu was engaged in conducting cutting-edge research in the area of next-generation rechargeable batteries from 2017 to 2018, after completing his PhD in 2015 from the department of Chemical Engineering, National Taiwan University of Science and Technology. He is currently an Assistant Professor of Chemistry at Kotebe Metropolitan University (KMU), Ethiopia. Capital linked up with this extraordinary scientist for an analytical review of his cutting-edge research. Excerpts;

Capital: How would you explain the next-generation rechargeable batteries?

Andebet Gedamu: First, I would like to make clear that the existing commercially available rechargeable batteries, which are largely lithium-ion batteries, suffer from low energy density and is approaching the theoretical value. On the other hand, the development of portable electronics, electric vehicles, and grid-scale energy storage systems which require batteries with a higher energy density are growing rapidly. The trade-off between high energy demand and huge performance gap of existing systems led to the developments of next-generation rechargeable batteries. We can describe next-generation rechargeable batteries as energy storage systems with superior characteristics of outmost importance. They have higher energy densities, light weight, better safety characteristics, environmentally friendly and longer cycle life than the current battery systems, often while simultaneously cutting costs.

Capital: Are these batteries lithium-ion? How long will they last and how fast can we charge them?

Andebet Gedamu: Next-generation rechargeable batteries include both advanced lithium-ion batteries such as all-solid-state lithium-ion, lithium-metal, lithium-air, lithium-sulfur and post-lithium battery chemistries such as sodium-ion, multivalent metal-ion, metal-air, redox flow, etc.

Yes, the durability and speed of charging are both critical issues in commercialization of battery especially in electric vehicles which are powered exclusively by batteries. The current, lithium-ion batteries suffer from slow charging time, low cycle life and low energy, which can significantly impact the overall performance of the device. In fact, the newly emerging batteries vary each other greatly in terms of various parameters but, regardless of their type and application we expect batteries charged within a couple of minutes. The battery packs will also be designed to last for more than a decade of life. However, I believe that no single battery technology will dominate the industry at large.

Capital: These batteries are already reaching out to the market, what makes your batteries different from these that are already in the market?

Andebet Gedamu: Yes! New advanced batteries are currently in research and development, plus a few types of advanced batteries are also currently commercially available. Since battery is a complex electrochemical system, various requirements must be achieved before released to the market. For instance, high energy and power density, longer cycle lifetime, lower cost, fast charging time, environmentally friendly and safe. I believe that over time advanced battery will eventually replace some, if not all, current commercial rechargeable Li-ion batteries.

My research project mainly focuses on enabling the use of silicon electrode as an alternative to graphite electrode in Li-ion batteries. I would like to make clear what is the major gap of the current existing lithium-ion battery. Most commercial lithium-ion batteries are based on graphite anode electrode, which has a maximum attainable capacity of 372 mAh/g. Hence, graphite fails to meet future demands of the optimal capacity of 1000 mAh/g. In this regard, silicon stands as one of the most outstanding options, with a theoretical capacity close to 4000 mAh/g, more than 10 times higher capacity than graphite. Therefore, the shift from graphite- to silicon-based electrode can significantly increase the energy density of batteries. In addition, silicon is highly abundant and environmentally friendly. However, large volume change of silicon during charging and discharging process remains the major challenge in commercialization of silicon-based anode batteries. Therefore, researchers in this area, including my research, aim at designing electrode integrity and increase battery life.

Capital: You were one those who were selected from Ethiopia by the Next Einstein Forum that offer opportunities for mentorship and collaborations with established researchers. Can you explain how you will benefit from this?

Andebet Gedamu: You are right! I am the Next Einstein Forum Ambassador, representing Ethiopia for two years until the end of 2021. Like other African scientists, one of the challenges in my career is lack of research funding and collaboration. To this end, NEF helped me to connect with leading scientists and make collaborations and networks with other NEF members and other renowned scientists. In addition, NEF creates several platforms to present my work at global level and thereby gain global visibility to my research outputs. It also creates chances to meet successful African scientist and leading innovators which will help me to become acquainted with how to tackle the real challenges that hamper to conduct research. As a young scholar and researcher, I am challenged with the way how my research outputs to a level of end-user products. In this regard, NEF creates an opportunity to communicate with industries, product developers and other stakeholders.

Capital: What do you think the future of battery technology will be?

Andebet Gedamu: In fact, the answer for this question is not as such simple, as it depends on a range of factors, from the speed of innovation to the ability to reduce costs of the new technologies. But, as there is a high expansion of smartphones, computers, tablets, electric vehicles, flexible and wearable electronic devices and other portable electronic equipments there is a growing demand for high-performance rechargeable batteries for these devices.

There are still significant challenges to implementing new battery materials, such as silicon which I mentioned earlier and high-voltage cathodes. If both changes can be made, I think, we could see batteries with better mechanical and electrochemical properties in the market within a couple of years. For instance, leading automobile manufacturers, including General Motors, Ford, Toyota, Nissan, Honda, and Tesla, are actively engaged in the design and development of Electric and Hybrid Vehicles and established giga factories to produce high-capacity, reliable batteries, hinting that a future switch for EVs could soon take place. Overall, I would say the future of battery technology would be very exciting and bright.

Capital: How can Africa benefit from this technology?

Andebet Gedamu: Africa’s population is increasing very rapidly. Concurrently, the need for portable electronic devices and electric vehicles is growing rapidly in the continent. In this regard, next-generation batteries are expected to promote the sustainable development of the society. Africa has huge potential for solar, wind, hydroelectric, geothermal power, and other sustainable energy sources. Thus, highly reliable and well-designed stationary batteries with higher energy, better charge-discharge cycle and durability characteristics are needed to ensure electricity from these renewables can be stored for use when the wind isn’t blowing or the sun shining. In addition, Africa is rich in resources. For example, cobalt, one of the key elements for battery making, is in the Democratic Republic of Congo with more than half of global supply. However, as the rest of the world is heading to new green energy storage systems, I am afraid Africa will be dumping ground for the existing old batteries unless researchers, industries, product developers and other stakeholders are engaged to developing new energy storage systems.

Currency outside bank contracts

Recent policy measures linked to the drop

The imposition of cash withdrawal limit and the recent demonetization policy measures has significantly contracted currency outside banks by more than 40 percent in the first quarter of the finance year compared with the preceding quarter.

In the first quarter of the year of 2020/21 that is from July 1 to September 30, 2020 the currency outside bank stood at 64.7 billion birr. In the fourth quarter of the 2019/20 financial year that amount was 109 billion birr.

The National Bank of Ethiopia (NBE), central bank, quarterly review indicated that in the first quarter the currency outside banks has contracted massively and showed a drop of 40.7 percent compared with the preceding quarter and 29.3 percent compared with the same period of last year.

At the end of the past financial year, the central bank had imposed the cash withdrawal limit directive that was followed by demonization of the birr, which was also a massive policy arrangement regarding cash management.

On its review, the central bank said that its latest policy measures have contributed to the drop of cash outside banks.

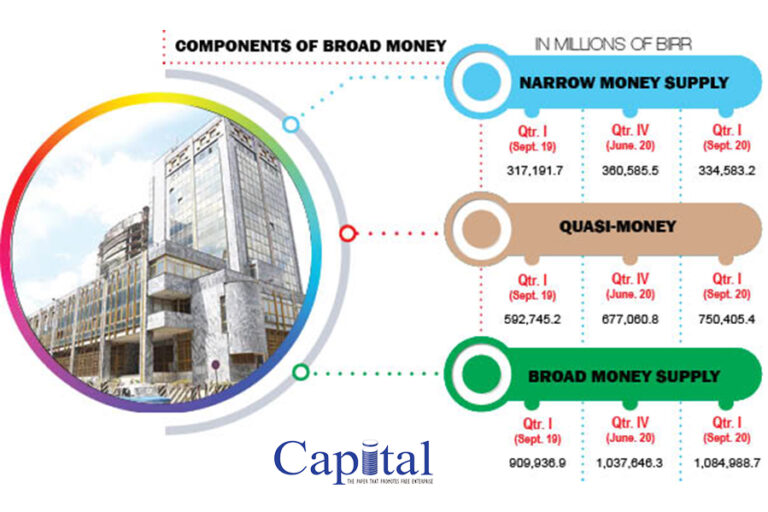

“Narrow money supply (M1) exhibited a 5.5 percent annual growth and 7.2 percent quarterly contraction mainly due to the imposition of cash withdrawal limit following the recent demonetization policy measures,” NBE said.

At the stated period, the broad money supply (M2) stood at 1.1 trillion birr at the end of first quarter of 2020/21, showing a 19.2 percent annual expansion owing to 136.0 percent surge in domestic credit despite 9.9 percent decline in external asset 21.3 percent growth in claims on government and 18.6 percent in increase in claims on non-central government were the major driving forces for the expansion in aggregate domestic credit.

The M2 has an increment of 4 percent compared with the preceding quarter, while the quasi-money supply from M2 showed a 26.6 percent annual and 10.8 percent quarterly expansion.

From the total M2 the quasi money, which includes saving and time deposits, share stood at 750.4 billion birr. On the other side the M1, which includes currency outside banks and demand deposits, share from the total 1.1 trillion birr of M2 is 334.6 billion birr.

The M1 has dropped by 7.2 percent because of the contraction of currency circulating outside banks, while the demand deposits from M1 has expanded by 19.6 percent of the same period of last year.

As expected, reserve of banks have also boosted by over double due to the latest measures taken by NBE on currency holding and demonization.

According to NBE, excess reserve of commercial banks surged 109.3 percent on annual and 27 percent quarterly basis, “Demonetization measures as well as the NBE directives setting cash holding and cash withdrawal limits have aided commercial banks to significantly increase their deposit mobilization and to improve their liquidity position.”

“Thus, money multiplier, measured by the ratio of broad money to reserve money and narrow money and reserve money declined on both annual and quarterly basis,” NBE explained the success achieved.

The excess reserve of commercial banks as of September 30 has stood at almost 68 billion birr from 32.4 billion birr of a year ago.

Banks despot at NBE has also expanded by 118 percent from September 30, 2020 and reached 137 billion birr from 63 billion birr.

NBE’s quarter review indicated that reserve money amounted to 261.4 billion birr at the end of first quarter of 2020/21, showing 39.9 percent year-on-year and 6.0 percent quarterly growth.

The reserve money currency in circulation has dropped by 11.5 percent compared with the preceding quarter from 140.5 billion birr to 124.4 billion birr, while it has a 0.3 percent a year-on-year increment.

The latest decision of the central bank on massive reforms helps banks to expand aggressively.

“The surge in quasi-money was the result of a successful effort made by banks in expanding their branch network and improving service outreach,” it says, “Moreover, currency demonetization and cash withdrawal limit helped commercial banks to mobilize more fresh deposits.”

The 19 banks operated so far have opened 117 new bank branches during the review period, thereby raising the number of bank branches to 6,628, while more than one third is located at the capital city.

The NBE review shows that total resources mobilized by the banking system (the sum of net change in deposit, loans collected and net change in borrowings) rose by 132.5 percent over last year due to the policy change made by the National Bank of Ethiopia; with respect to ‘Legal Tender Protection Directive’ that restricts cash holding and cash withdrawal limits and demonetization measures that led to result high deposit mobilization in the first quarter of 2020/21.

The banking system resource mobilization has shown drastic change compared with the same period of the preceding year and the previous quarter because of the NBE new laws and demonization.

The review indicated that the deposit mobilization has been expanded by fivefold compared with the 2019/20 first quarter and stood at 105 billion birr, which has also climbed by more than double compared with the last quarter of 2019/20 financial year.

The total resources mobilization that includes loan collection, borrowing and deposits has also increased by 132.5 percent and 25 percent from similar period of last year and proceeding quarters respectively and stood at 141 billion birr.

Banks liquidity has also surged by 5.5 fold and 75.4 percent from similar period of last year and preceding quarters respectively that stood 85 billion birr.

The total deposit liability has also expanded by a quarter annual growth rate and reached 1.15 trillion birr. “NBE’s Directives setting daily cash withdrawal and cash holding limits as well as demonetization measures have contributed to such a remarkable performance in deposit mobilization,” NBE amplified by its review.

Demand deposits, which accounted for 33.9 percent of the total deposits, reached 388.3 billion birr showing a 22.1 percent annual increase.

Similarly, saving deposits went up by 31.2 percent to Birr 659 billion and accounted for 57.5 percent of the total deposits. Time deposits, which constituted 8.6 percent of the total deposit liabilities, rose by 2.5 percent and reached Birr 99.1 billion. The share of state owned banks in total deposit was 57.3 percent while that of private banks was 42.7 percent.

During the review quarter, 55 billion birr was disbursed in fresh loans, indicating a 16.8 percent annual increase. Of the total new loans disbursed, the share of state owned banks was 30.3 percent and that of private banks was 69.7 percent.

The banking system collected loans to the tune of 35 billion birr, about 14.9 percent lower than a year earlier.

Total outstanding credit of the banking system (including corporate bond) reached 1.1 trillion birr, about 22.4 percent higher than last year same quarter.

NBE gross claims on the central government as of end September 2020 has reached 243.1 billion birr about 22 percent higher than a year earlier. Of this sum, government bonds accounted for 81.6 percent while direct advance constituted the remaining 18.4 percent.

The share of direct advance to central government dropped by76.7 percent compared with last year due to its conversion to government bond, thereby increasing the share of bonds.

The deficit in the overall balance of payments narrowed to USD 177.4 million during the first quarter of 2020/21 compared to USD 870.5 million deficit a year ago on account of slowdown in merchandise trade deficit coupled with an increase in net private transfers and net official transfers.

The private transfers that includes NGOs and private individuals has increased by 39 percent of a year ago and stood at USD 1.55 billion, while the private individuals transfer has climbed by 46.5 percent to reach USD 1.33 billion.

Similarly, the net official transfer has been USD 267 million that was 194 a year ago, but it has dropped by 57 percent compared with the preceding quarter that closed on June 30, 2020.

MoTI orders brewers to revert to previous prices

Dashen complies with the order

Ministry of Trade and Industry (MoTI) orders brewers to restore the latest price adjustment to the previous rate.

Sources told Capital that a week ago MoTI wrote a letter for breweries who revised the sales price to return to the previous rate.

Eshete Assfaw, State Minister of MoTI, confirmed that the ministry has pushed the factories to restore their price.

He told Capital that the companies have informed them to re-revise their measures, while some of them are arguing that there are external pressures for the price revision.

So far, Dashen has reverted its rate to the previous price following the government’s pressure.

Breweries like BGI Ethiopia and Heineken that increased the price have yet to return to the previous rate. The two brewers are the biggest player on the market with different breweries in different corners of the country.

The State Minister indicated that brewers have raised issues related with tax and other factors. “They will get proper response in the coming week,” he said.

Currently, there are six beer companies which operate in the country, and most of them are dominated global operators mainly by Europe based companies.

About two weeks ago, brewers have revised the bottled beer tariff by about 50 birr per crate and 130 birr on a draft keg.