Emirates has announced a collaboration with Huawei, one of the world’s top smartphone brands, to promote the Emirates app to Huawei phone users and build a more convenient and rewarding experience for passengers as travel demand recovers in the post-pandemic era.

Since January 2020, Emirates passengers have been downloading the Emirates app (Android version) at AppGallery and benefiting from its rich range of functions. The recent enhanced collaboration between the two parties extends the shared platform to include SmartCard Integration, providing a quick booking option for Emirates app users in the Chinese mainland and the UAE, as well as the ability to easily access their travel and flight information. Emirates-themed wallpapers, icons and fonts will also be created for travel enthusiasts to download and inspire their next travel plans and to customise their mobile experience.

Emirates collaborates with Huawei to bring enhanced mobile app experience

The history and fresh face of Ethiopian Currency

Ethiopia is one of the ancient global civilizations that had its own currency, which at the time were coins. In different occasions and periods the coins had been changed and at times non Ethiopian coins like the Maria Theresa thaler, the silver bullion coin, commonly referred to as the mint of Austria were used.

At about 1903, as modernization hit, the new Ethiopian coinage appeared.

The thaler became the standard unit on 9th February 1893 and 200,000 dollars were produced at the Paris Mint in 1894 for Emperor Menelik II.

In the contemporary history of Ethiopia the first banknotes or paper money were rolled out in 1915 by the Bank of Abyssinia.

The Bank of Abyssinia introduced banknotes having denominations of 5, 10, 100 and 500 talari, and 280,000 talari worth of notes was printed at the time.

A 50- talari note was added to the mix in 1929. At that time over 1.5 million talari in notes were already circulating in the market.

History indicated that though the paper money had been minted in the early 20th century, it was received with difficulty of acceptance by the public. The general public preferred to use the picture button coins of Emperor Menelik II and Maria Theresa thaler and the traditional bar of salt (amole).

Throughout time when the banknotes have been in use it remained without feature changes until 1945. According to Yinager Dessie, Governor of National Bank of Ethiopia (NBE), until 1945 different foreign currencies had been in use in the country and these include; the British East African shilling and history also states that after the Italian occupation lira had been in circulation.

The Emperor Haile Selassie Banknotes

In 1945, four years after Ethiopia became free from Italian invasion, Emperor Haile Selassie came up with a new decree that enforced the use of the new Ethiopian banknotes with the feature of the Emperor and in denominations of 1, 5, 10, 50, 100 and 500 birr. In process the 500 birr faced suspension and was phased out.

The Emperor Haile Selassie’s banknotes’ was introduced on the 23rd of July 1945 and continued circulating until 1976 with minor changes in its feature. Yinager further stated that the Emperor Haile Selassie banknotes were the currency that was effective for long period of time.

The DERG currency

On September 1976, the notes issued by the DERG fully changed the features of the emperor notes. The notes mainly reflected the socialist political ideology that the DERG administered. The DERG currency remained in use till 1997 despite the regime being removed from power in 1991.

In November 1997, EPRDF, the government that was in control changed the DERG currency by issuing minor features and colour changes. The higher denominations, that is, 50 and 100 birr received improved security features.

Information that Capital obtained from NBE shows that the money circulating in 1997 in the market was an estimated 4 billion birr. The central bank printed 8.07 billion birr worth of notes on the replacement of the currency at the time.

The fifth fresh face currency

Early this week the government of Ethiopia introduced new currency notes, with enhanced security features and other distinctive elements. The new currency notes replaced the 10, 50 and 100 bill notes while an additional 200 birr note was introduced.

The new currencies are totally different in features from what was being used 44 years back.

The notes are reflective of the natural, historical features of the country besides anticipating the future strategies like industrialization and modern agriculture.

NBE said that the 5 birr note will remain unchanged and will be turned into a coin format soon. The 5 birr note will no-longer be printed and that it will be converted to coin format soon.

Yinager told Capital that the government has been in operation for the past ten months to change the currency but the project was faced with significant delay because of COVID 19.

In the meeting held at the Office of the Prime Minister on Monday September 14 the Governor said that the printing process faced setbacks as the workers were unable to go to the printing house because of the virus.

“We had planned to introduce the new notes about three months ago, but the outbreak forced us to reschedule the plan,” Yinager told Capital.

The government disclosed that 2.9 billion notes with the value of 262 billion birr have been printed. For printing the money the government paid 3.7 billion birr which on average means 1.275 birr per note.

When the country changed the currency in 1976 it costs 18 million birr which is 205 times lower than the current cost.

Yinager stated that the average of 1.275 birr per note was not reflective of the separate individual denominations. For instance the print cost for 200 birr note is not similar to the 10 birr note. The 200 birr security features included the latest technology like spark that is used in other big currencies in the world that consequently costs the government much more.

“For the biggest denomination, 200 birr, we decided to preserve it from forgery thus we scaled up its security features,” the Governor said.

According to Prime Minister Abiy Ahmed, the volume of notes printed is very high. He said that the 10 birr notes printed for the current change is much higher than the total notes printed in the 1997 currency change. This is an indicator of how much huge money has been circulating in the market.

Prime Minister Abiy has ordered the implementation of tight security on borders and Bole International Airport to control the money that may be smuggled to and from the country. The command post accountable for the success of this endeavor includes the National Defense, National Intelligence and Security Service and Federal Police.

According to the plan, those who have more than 100,000 birr should change their currency within a month’s time and those who have 10,000 birr should save their money in banks. Banks however insist that individuals who have 5,000 birr should open a bank account to save their money.

Yinager said that the currency change was mainly motivated by economic reasons, that is, to return the cash that is out of the bank system back to the bank. Furthermore the move seeks to counter the contraband and corruption issues thus helping to support financial institutions confront currency shortage.

The Bankers Commentary

Recently, the Bankers Association disclosed that since it has been over half a decade the currency change was a requirement needed to reduce the cash amount that was out of the banking system.

The association president welcomed the government’s decision since it has massive result to the sector and the overall country’s economy.

Abe Sano, president of Commercial Bank of Ethiopia and current head of Bankers Association, stated that in order to meet the anticipated target the period should be reduced to one month from the three months of currency change time.

He added that the time frame that is given for those who hold more than 100,000 birr should reduce to 15 days. He further emphasized that those who are supposed to open bank accounts should start savings from 5,000 birr from the proposed 10,000 birr.

“In the previous notes change that was conducted 23 years ago the number of bank branches was very small which is not the case now, therefore an extended period may not be needed on the changing process,” Abe said.

According to NBE’s quarterly bulletin that shows the overall economy from January to March of 2020 the total bank branches in the country had reached a total of 6,362 of which 70 percent of them are private banks.

Consequently, one branch on average serves 15,848.6 1 people.

For the comments made by the Bankers Association, Abe stated that the timeframe was one of the debated issues by the group who conducted the project. The project was known as project X and was secretly conducted by very few individuals.

“If we give an extended period for this procedure, the process shall put extra pressure on the banks. If you have conducted the operation within the few stated periods it may be restructured based on the discussion with NBE and banks,” Abe explained.

The latest economic bulletin of NBE indicated that in March the broad money supply (M2) stood at 986.8 billion birr showing an 18.6 percent growth over the corresponding quarter of last year. The broad money expansion has expanded by close to 28 times or 2,741 percent in the last 15 years.

The NBE document indicated that at the end of third quarter of 2019/20 fiscal year, quasi-money supply depicted 14.9 percent annual expansion and 1.9 percent quarterly increase. Narrow money supply surged 25.7 percent on annual and 7.3 percent on quarterly basis. Narrow money contributed 47.0 percent and quasi money 53.0 percent to the annual M2 growth.

From the narrow money supply that stood at 356 billion birr the currency outside banks is 109.3 billion and the balance is on demand deposit. The currency out of banks has significantly climbed like M2 in the past couple decades.

For instance at the close of the second quarter of 2004/05 fiscal year, which is 15 years ago of the last fiscal year, the broad money supply was 35.9 billion birr, while the currency outside banks was 8.27 billion birr. This is a significant increase of 13 folds approximately 1362%.

To save Ethiopia from collapse

Today let’s reflect about history and national identity: Two subjects that can (most of the time) influence each other.

Goethe, the 18th Century German writer is reported to have said: “Not all that is presented to us as history has really happened; and what really happened did not actually happen the way it is presented to us; moreover, what really happened is only a small part of all that happened. Everything in history remains uncertain, the largest events as well as the smallest occurrence…”

In other words History is generally written wrong and is always written, and rewritten in the present, making the present the past.

Learning about history is not about making any one person or group of people feel guilty. One cannot be guilty of actions that took place before she or he was born. But one can be guilty for remaining ignorant and not learning about his or her history, and then repeating the same mistakes in the future. That’s why history is so important.

Unfortunately, Ethiopia’s history is highly disputed. We don’t seem to know what it is. We don’t want to remember exactly what happened. There is no authoritative or generally-accepted position as to precisely what our past entailed. Everyone can choose the facts they like and dismiss those that are challenging or ugly? Ethiopia’s history written by an Oromo and an Amhara is likely to be the history of two seemingly different countries.

Indeed, a century after the end of Menelik’s era the battles about the right interpretation of his reign are still being fought in Ethiopia. Politicians have claimed a dominant role in these debates, often engaged in historical reconstruction: trying to define or redefine national identity often with little sensitivity and, if I may say so, some degree of unreality or abstraction. Now, that period has come to an end. So why persist in fighting enemies long gone or in conquering territories that no longer exist? The world has changed, Ethiopia has changed, and a new narrative is necessary for Ethiopia to achieve its declared aim of equality and prosperity.

Let me now switch to national identity.

In Ethiopia we seem today to be confronted by three competing political tendencies to form the ‘new’ Ethiopia: The First is the civic nation, which is based on citizenship of Ethiopia, rather than on any form of ethnic characteristics (unitary or federal system of government). The second is a community of nation states – which supports ethnic based nation states and opposes the concept of a civic nation (the existing system). The third, perhaps the most hedonistic of all (advanced by a small fringe of Oromo nationalists) calls for a state on the basis of the sovereignty of one particular ethnic group – the Oromos.

In each group, a small section of political and media propagandists are trying hard to construct the foundation of a national identity. The problem is that there isn’t much ‘usable past’ to anchor the new Ethiopia as a cohesive one nation upon which unity and identity are founded. The reality is that each of Ethiopia’s nation seeks to use Ethiopia to protect its own particular national identity and develop its own idea about statehood. The more obvious reality is the Ethiopia statehood is competing with its individual nations’ desires for statehood.

From this standpoint we ask: who are WE? What are the foundations of our identity? What do we understand by the term “Ethiopian” and to what extent do our concepts of national identity vary with age and ethnicity? Why remain silent about the issue of identity? By avoiding this vital question on the pretext that this is not the time to discuss this matter or it brings discomfort to some political actors, the present leaders are contributing to a weakening in support for Ethiopian integration and unity.

Can Ethiopians unite again around a shared national story?

We first need to recognize (my observation) that many young people in Ethiopia have shallow and superficial notions of identity and, at best, an ambiguous attitude to other nationalities. Obviously within the context of the current Ethiopia, this narrow parochialism needs addressing – the question is how?

Nation-building is undoubtedly complex and contested, it involves a shared sense of national identity, built on elements that tie people together – such as shared culture, language, and history. Today’s Ethiopia has no agreed vision or destination, has no common goals as a nation. As a society, we have not yet decided to be good at anything. We prefer the easy way to heaven on earth. We prefer handouts rather than work hard. We dispute economic struggles and efforts to maintain the maintainable. What drives politics in Ethiopia is not the massively corrupt, unequal economic system that benefits the few more than the rest of the nation, regardless of ethnicity, but ethnicity. Yes, ethnic politics is tearing this country apart. That is what EPRDF has achieved, and that’s what is still tolerated today. I believe this is the greatest moral challenge of our time – but how do we construct a nation identity?

Where to even begin? Well, here’s one way.

Let’s move away from basing our identity on borders, and instead turn the relationship the other way around. An identity based on a shared homeland, or territory, along with shared law. National loyalty makes possible the kind of self-sacrifice that is necessary for living in peace with stranger, for contributing to common treasuries whereby we provide for one other regardless of our ethnic background and religion. The border is just what you draw around this home. Let’s make sure that all citizens live in a country where no one has to constantly consider his or her ethnic identity. Let’s create shared prosperity in the face of a rapidly changing global economic landscape and increasing inequalities, in other words let’s not leave anyone behind. Of course these are not enough for building a national identity… But you can add some more.

When it rains, it pours

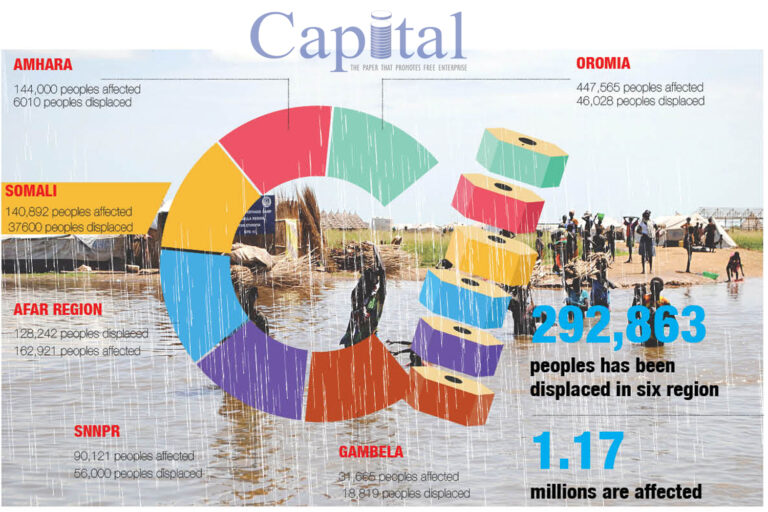

The heavy rainy season characterized by torrential rainfall and accidental floods has rendered suffering to 1.17 million people in six regions of the country.

According to the national disaster and risk management commission, the torrential rainfall that started in the middle of August displaced 292,863 people in six regions, and this ripple effect has gone on to affect 1.17 million people who are currently looking for aid.

In most cases, floods occur in the country as a result of prolonged heavy rainfall causing rivers to overflow and inundate areas along the river banks in lowland plains.

The backflow induced by Awash and Kesem rivers has resulted in accidental floods in the Oromia and Afar region, which is among the major river flood-prone areas lying along the upper, middle and down-stream plains of the Awash River. According to the commission, the flood has occurred in five woredas of Afar region, namely; Awash Fentale, Amibara, Dubecha, Gewane, Gelealo. About 128,242 people have been displaced and 162,921 people have been further affected in the Afar region. Furthermore, about 16,000 hectares of large farms in the two woredas are underwater.

In Oromia, three woredas, namely; Fentale, Merti, and Wenji weredas have caused 46,028 people to be displaced and an additional 447,565 people have been further affected.

Extensive floodplains surrounding Lake Tana and its major tributaries at times of heavy rainfall in Amhara region, East Gojam zone Fogera and Dembia woredas have also affected 144,000 people and an additional 6010 people have been displaced.

In Somali region more than 140,892 people have been affected, in which more than 37,600 people have been displaced courtesy of the overflow of Wabe Shebelle, Genale and Dawa Rivers

Moreover, in Gambela region, 31,665 people have been affected with 18,819 people being displaced.

Down-stream areas along the Omo and Bilate Rivers in the SNNPR region 90,121 people have been affected by floods with a further 56,000 people being displaced from their homes.

The general farming scene (Crops and animals) has also been tremendously affected in the areas.

According to Debebe Zewde Public Relations Director at the commission, so far there are no deaths reported from the flood. He continued to express that the government has been relocating the victims to safer places using helicopters and boats. “The government is trying to deliver food and nonfood aids including medical items, furthermore NGOs and individuals are chipping in to support the people,” said Debebe.

According to Debebe, starting from April the commission has been warning regions and risk prone areas based on the report of the national metrology and drainage development agency, however as he stated the heavy summer season has aggravated the situation. By definition, this type of flood is characterized by sudden onset with little lead time for early warnings and often results in considerable damage to lives, livelihoods and property.