Ethiopian Shipping and Logistics Services Enterprise (ESLSE), the only flag carrier in Africa, set a strategy to commence cabotage and passenger services.

The logistics giant and multimodal monopoly indicated that in its five year strategy it will include more services including adding new medium size vessels to help achieve its goal.

Roba Megersa, CEO of ESLSE, asserted that regarding potential, ESLSE is in a good position in Africa to commence cabotage service to serve coastal areas in the region. Cabotage is the transport of goods or passengers between two places in the same country by a transport operator from another country.

“To commence the operation second hand properties might be assigned,” he said.

The cabotage operation focuses within particular territory that might be in a single country ports or ports cross border. In this case it might be transport from Djibouti to ports in Eritrea or Kenya and others, according to the CEO.

The sea and inland fleet giant has targeted to boost its fleet mainly in the bulk operation. To attain the target ESLSE undertook detailed study to secure two more medium size vessels.

“The study was concluded and is approved by the board of directors to procure brand new vessels,” Roba told Capital.

“There are two options to acquire new vessels; the property that is already being built for others and the deal might be terminated is the first way, or in other way order from the scratch,” the CEO explained.

“If we get a chance for vessels that is under construction the time will be shorter to receive it, otherwise in the coming two years we will get the vessels based on the second alternative,” he added.

According to the plan, Roba said that the vessels will have a capacity of 63,000 dwt, while the multipurpose vessels that Ethiopia operates now have a capacity about 28,000 dwt.

“This size of vessels are known as ‘supramax bulk carrier’ that are highly preferred for bulk carrier in the industry,” he says adding “they are profitable and we can even lease them for others, but at the same time we know the business and have now grabbed the fertilizer, coal and wheat business, due to that these vessels are very crucial for our operation.”

According to the CEO, the new vessels will be different from the current properties. “The two vessels will focus for bulk carrier,” he asserted.

About a decade ago ESLSE bought nine vessels including two tankers that it received in different time frames. The nine vessels consume USD 234 million and the major share was covered by Export Import (EXIM) Bank of China. Roba said that most of the loan has been paid, “so far over USD 190 million have been paid and the balance will be paid shortly.”

“We settle the loan on biannual basis that is approximately USD 17 million for each,” he added. He said that the local portion of the loan has already been settled and the foreign exchange is at its final stage.

The CEO is confident that his enterprise will not face a challenge to finance the brand new vessels that will be purchased in the near future.

“Since we keep the payment schedule we showed our credit worthiness to our lenders,” he said.

“We have a liquid asset and due to that the finance and guarantee issue will not be a problem. Of course we will use foreign finance to buy the new vessels and not need other warrantee to access the finance,” he explained.

The two tankers, Hawassa and Bahir Dar, have about 42,000 dwt capacity and they are the first tankers for the operator.

ESLSE also target to commence passenger transport with ferries. In the region there is a potential to commence passenger services with ferries. The price will be competitive than air transport, according to the CEO. The ferries are bound to take passengers from East Africa to the Middle East. The scheme is also included in the five year strategy.

ESLSE established in the mid-1960s is the strongest vessel operators and is the only cross continent operator in the African continent.

“We have cargo agents at 327 ports in the world, which is very big,” the CEO descried the capacity of his enterprise, “we retain in the market does not mean we have a fleet but we are engaged in consolidation with agents.”

“We are using our network and buy other slots to transport cargos. Partly we are non vessel owning common carrier (NVOCC), which is an operator that may actually does not have vessel but operate in the business like DHL,” he explained.

The enterprise is also engaged on West African market chartered service. “Recently the enterprise has transported a project cargo from China to Senegal. The business is encouraging and we will continue to operate,” the CEO concluded.

ESLSE to start ferry service

CONSEQUENCES OF PHONY MONEY

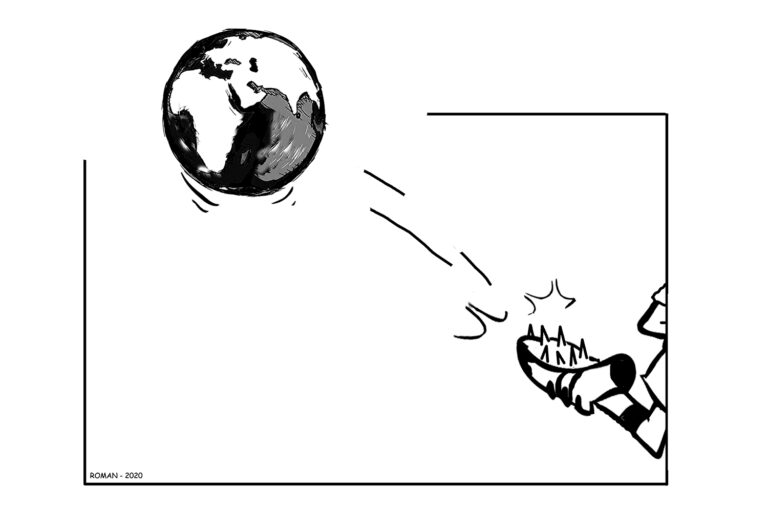

Fiat money is a money system where the physical currency in circulation along with other forms of money used in various transactions (bank money, etc.) is not backed by anything material, i.e., not real. In previous eras, money was invariably backed by something like gold, silver or other commodities (salt, silk, etc.) If truth be told, the only thing fiat currency has going for it is its backing from organized violence, in this case, the states. In all history, the regime of fiat currency has always been short lived and almost always ended up in inflationary collapse! But, since politicos occupying the apex of government make all major decisions of the state, expecting responsible behavior, particularly in regards to money and its management, was never a tenable proposal, to say the least. As a result and just like those previous interspersed eras of fiat currencies, our prevailing world system is now awash with massive amount of phony money that is threatening to trigger severe dislocation of the world order!

Many an informed reader knows that the current global money regime was set up in 1944, in Bretton Woods, New Hampshire, USA. One of the major agreements reached between the countries was that gold would anchor the world’s money system. This was to be done via the US dollar. Thirty-five US dollar was to be convertible to an ounce of gold. Since all other currencies were pegged to the USD, it followed, all currencies were backed by gold, albeit indirectly. That was the basis for the stability of global money in the post WWII era. In 1971, the US was financially bleeding on the account of its entanglement in South East Asia. Vietnam, Laos, Cambodia and others became war theatres for decades. Consequently, it became clear that the US was not able to meet its responsibility of delivering gold when presented with its dollars by others. The last straw that broke the Bretton Wood Agreement came from France. The then President of France, Charles de Gaulle brought plenty of dollars and demanded the shining metal. Mr. Nixon, the US president at the time, unilaterally declared that the gold window was closed and henceforth the US currency was to be a free-floating currency that will not be backed by anything, period! Thereafter and by extension all global currencies became fiat! This was a Godsend to many financially stranded countries, as they can now print money with abandon. The inflationary consequences were not immediately visible, until the late 1970s and 1980s. The rest, as they say, is history!

Inflation was a rare phenomenon in the long history of the world economy. It was deflation that was the most prevalent in the olden times and economic crisis were invariably triggered by deflation, not inflation! We admit; this can be quite difficult to take in, particularly to those who are born recently and are innocent of economic history. We believe a little sober reflection can reveal why the deflation animal dominated the past. When money is pegged to something tangible with intrinsic value, printing of currencies cannot be done at whim. This in turn tends to restrict speculative economic activities. Money becomes rare and precious. Let’s look at consequences of fiat money as it plays on existing economic reality. For instance, if real money was efficiently employed, rather than phony money, only 20% of the current global workforce is needed to deliver today’s global output! That is why the current shutdown due to the declared pandemic that formally reduced global GDP by about 50%, has not had as disastrous an effect as many expected! The global speculative mania, which came into existence after 1971, managed to flood the world with copious and unnecessary ‘white elephants’. The destruction of the natural world, especially the ecosystem, along with the pauperization of the global working stiff or the sheeple (human mass) in general, is the root cause of the ongoing & impending worldwide insurrections. See Hulsmann’s article next column. From the numerous ghost cities and 90 million vacant apartments of China, to the giant unicorn corporations of the west (Tesla, et al.), to the zombie companies of the wretched countries, bent on replacing pristine nature with concrete junk, will run into serious troubles when the world is forced to reset its financial architecture, hence its very economic creeds!

There are indications to suggest ascending powers of the world system might not settle for a new economic order, if it is going to be based, yet again, on fiat currencies. To this end, Russia, China, Iran, India, Venezuela, Iraq and many other countries have started to hoard precious metals, mostly gold, in anticipation of the new world order to come. Understandably, what this lopsided financial regime did to many resource rich countries in the past is laughably ludicrous. For a change, resource rich countries would like to see an exchange mechanism that can genuinely respect the non-renewable nature of their resources. Commodity (gold, silver, oil, etc.,) backed currency is what is proposed by the likes of Putin for the coming new global economic order. China is feverishly working on a gold backed crypto currency to mitigate the negative effects of the current reserve currency, namely the USD. Put together, the immediate future of the world system promises to be quite rocky! On its part, empire doesn’t seem to be in a hurry to address the situation; instead, it is concocting other problems to divert the global sheeple’s attention. Such an approach might not work this time around! See the articles on page 34.

“The gold standard alone makes the determination of money’s purchasing power independent of the ambitions and machinations of governments, of dictators, of political parties, and of pressure groups. The gold standard alone is what the nineteenth-century freedom-loving leaders (who championed representative government, civil liberties, and prosperity for all) called ‘sound money’.” Ludwig von Mises. Good Day!

SMLH extends third and final round of support to Hizbawi Serawit School

The Ethiopian section of the SMLH-ONM, Société des Membres de la Légion d’Honneur and Ordre National du Merite, as part of their three-month food support project for disadvantaged students of Hizbawi Serawit School and their families, donated the last and third round assistance on Saturday August 1.

The project that was launched on June 6th aims to benefit 100 students and their families in need of support from the school. To realize this project members of SMLH, Zemen Bank Labour Union, Icare ye Lycee LiJ, and other companies and individuals came together to contribute their part as their corporate social responsibilities.

“Our association, SMLH-ONM has provided basic need support for 100 students and their families aiming to alleviate the challenges that they face in relation to the COVID 19 pandemic for the last two months,” said Teguest Yilma, President of SMLH-ONM Ethiopia.

“Over 500 family members will be beneficiary of SMLH’s initiative,” Teguest explained saying “this is to encourage the students to focus on reading and studying as much as they can while they stay at home because of the pandemic.” She also thanked all those who supported the initiative.

Students and their families received basic food items like teff, edible oil, pasta, flour and sanitary products. This will continue for another one month, until September the end of the rainy season and hopefully school will resume, she said.

For SMLH that is formed to strengthen cooperation and friendship between French and Ethiopian communities, providing support for Hizbawi Serawit School is not the first time; the association has also inaugurated a tap water and hygiene facilities for the students.

Commander Pierre-Francois Ferri Navy- Military Advisor at the French Embassy said that France will always stand with Ethiopia. “France will assist in everything it can to support Ethiopia,” the Commander said during the event.

These students were part of the Addis Ababa City Government school feeding initiative that provides breakfast and lunch to children who go to school, but since schools have been closed due to the pandemic, the program has been halted.

Zerihun Korme, Yeka Sub City Woreda 2 Education Bureau Head also said that the community should stay vigilant about COVID 19. “The families and the students must be more careful in protecting themselves and others around them in these difficult times.”

Several actions have been carried out by the members of the SMLH for the benefit of the Hizbawi Serawit School, in particular through educational projects.

SMLH Ethiopia has supported the school in Addis Ababa which is located in a popular and historic sector north of the capital. Close to the French Embassy, this district, called “Farensaï”, was reserved in the 1960s by emperor Haile Selassié for the settlement of the families of the combatants who participated in the first peacekeeping operations in Korea and Congo.

The association of SMLH Ethiopia was formed in 2013 by the recipients of the French government’s award of the Legion of Honor and Ordre National du Merite in recognition of  eminent services rendered to their country and the strengthening of Franco-Ethiopian bilateral relations. SMLH-ONM Ethiopia brings together the decorated of these two French national orders living in Ethiopia, both French and Ethiopian nationals.

eminent services rendered to their country and the strengthening of Franco-Ethiopian bilateral relations. SMLH-ONM Ethiopia brings together the decorated of these two French national orders living in Ethiopia, both French and Ethiopian nationals.

Since 2017 the section was joined by those honored with French ministerial awards, mainly academic awards in arts and literatures as well as agricultural merit, and maritime merit among others.

Canal+ aims to join the pay-TV market by March next year

Canal + Group, a Paris based and one of the biggest global pay-TVs and that partnered with Ethiopian Bruh Entertainment is expected to be on air in March 2021 with local shows.

In connection with the visit of President Emmanuel Macron in March 2019 the French TV company that is owned by Vivendi, an integrated content, media and communications group, signed a memorandum of understanding with Bruh Entertainment for the implementation of a distribution agreement for the commercialization of a pay-TV offer.

Tewodros Abraham, owner of Bruh Entertainment, said that the pay-TV will commence operation in the beginning of the coming year.

There are two pay TVs in Ethiopia, while they are not considered as a streaming of shows based in Ethiopia or incorporate with local languages, according to Tewodros.

“We are undertaking the required preparation to commence Ethiopian shows with the pay TV channel,” he said.

Early this week Eutelsat, a French satellite operator, and Canal+ have signed a multi-year, multi-transponder contract for Ku capacity on EUTELSAT 7C to support the launch by CANAL+ of a premium DTH platform in Ethiopia.

“The deal signed this week with is very important, since they will provide dedicated platform for Ethiopia,” Tewodros said.

The pay TV is expected to commence its operation with up to 50 channels and in the future that will be expanded to 80 channels.

“We are looking at dedicated local shows with local contents,” he said adding “Ethiopian producers that might be engaged in movies, cooking channel, documentaries or talk show, should use this opportunity to use the platform.”

Shows that might be related with education system or job creation, which may include relevant government stakeholders, will have a space at the pay-TV, according to the Ethiopian partner, “because our capacity is very wide.”

“Currently we are engaged in discussion and also sign deals with local channels, movie production companies, and dubbing on foreign movies to Amharic is also going,” Tewodros said.

“Initially we are starting on Amharic but will expand with other local languages,” he added.

The price is expected to start from 300 birr per month, while the decoder will be available with a reasonable price and will be produced in bulk.

“Canal + have already partnered for the supply of the decoder that will be assembled in China,” he said.

The operation will be full high definition and Tewodros argued that there is a capacity locally to come with the standard production and it is also supposed to grow significantly.

“There are local channels who does have good capacity, while professionals are also available. When we started the operation they are encouraged to execute their skills, but still the sector should grow,” he said.

Besides local channels professionally selected relevant international channels like news and documentary channels will have a spot at the pay-TV. Obviously since the company is from France some selected French language channels that have a potential for Ethiopian audience will also have part at Canal + TV, which is exclusively dedicated to Ethiopia.

There are two pay TVs in Ethiopia, DSTV of the US and Star Times of China, but the Canal + pay TV is different because its platform is strictly focused for Ethiopia.

The company discussed with government offices like Ministry of Culture and Tourism to keep and promote Ethiopian culture than heavily promote foreign culture. “We will do our best to promote Ethiopian culture and unity,” the Ethiopian partner said.

Canal + have similar dedicated pay TV in Africa particularly in West Africa. The West African TV is different with European Canal + channels, but the language is French. “The Canal + Africa has given full attention for African programs, movies, sport and shows,” Tewodros explained. “In the meantime our strategy is the same with the west African trend, until the industry become strong and ample local content become available we may use foreign channels at the initial stage,” he said.

The local industry and TV productions, which include entertainment, educational, cultural, promoting products, history, should be growing as soon as possible, according to the owner of Bruh Entertainment.

“The industry was not growing in the past because platforms were not available, but now we have facilitated the platform,” he says “we will discuss on contents and seal a deal with professionals, who have ideas, to come up with their production as per the standard, condition and time frame,” he added.

To tap the potential the company also targets to support on development, capacity building, and resource supply.

“Canal + mainly focus on training and capacity building in West Africa that I observed in Cote d’Ivoire, which has one million subscribers of Canal +, and it will be also applied in Ethiopia,” Tewodros said.

He said that they have a plan to get up to one million subscribers in the coming four years. Meanwhile Ethiopia has wide population their pay TV and number of subscription for foreign pay TVs is very small.

Canal+ Group is the leading French audiovisual media group and a top player in the production of pay-TV. Through its subsidiary Studiocanal, the Group is also the European leader in the production and distribution of movies and TV series for international audiences.

Canal + Group is not new for Ethiopian pay TV market. With its local representative Syscom Plc, it has been transmitting the pay TV, Canal + Horizons, starting from 1997.

Teguest Yilma, Managing Director and Owner of Syscom Plc, reminded that several channels have been on Ethiopian air via Canal + Horizons.

She said that most of the channels have been French language that were mainly preferred by francophone residents in Ethiopia including the foreign community.

“Through time the group preferred to concentrate on other francophone African countries,” Teguest reminded how the pay TV left the country.

Vivendi is an integrated content, media and communications group, which also own Universal Music Group that is engaged in recording music, music publishing and merchandising. It owns more than 50 labels covering all genres.

Universal Music has also established Universal Music Africa that may help also promote Ethiopian music, according to Tewodros.

Eutelsat is already the leading carrier of Ethiopian channels through its 7/8° West video neighborhood.