The Ethiopian Economic Policy Research Institute which is under the Ethiopian Economics Association released a Policy Working Paper entitled ‘Economic and Welfare Effects of COVID-19 and Responses in Ethiopia: Initial Insights’ to review the economic impact of the pandemic.

‘The Novel Coronavirus, or COVID-19, pandemic is a global challenge that requires coordinated efforts from governments, individuals, businesses, and various stakeholders. The world economy is experiencing a historic and unprecedented shocks as the pandemic triggers a number of shocks simultaneously including health, supply, demand and financial shocks. Efforts by governments to control the COVID-19 pandemic through partial and full business closures unavoidably leads to general decline in economic activities domestically and globally. This contraction in economic activities leads to economic recession if the pandemic lasts for a prolonged period. Studies indicated that societies with a lower economic status are more vulnerable to rising rates of chronic illness from the COVID-19 further complicated by economic and social welfare hardships. This, in turn, further depresses productivity and raises health care costs, leading to increased poverty, and hence again more disease. This is a “disease-driven poverty trap” the report reads. The writers of this paper also said that this paper is released urgently to make it available for reference; hence it has not undergone a peer-review process.

The Ethiopian Economic

Ethiopia’s economic growth will decline by 9.9% in 2020

The Ethiopian Economics Association, policy working paper on the effect of COVID 19 estimates that the pandemic might slow down the economic growth by up to ten percent and exacerbate the poverty line by half at the worst case scenario.

The policy working paper issued under the title ‘Economic and Welfare Effects of COVID-19 and Responses in Ethiopia: Initial insights’ has evaluated the economic effect due to the coronavirus in different stages.

The paper has also advised the National Bank of Ethiopia (NBE) to consider reserve rate relaxation to enhance banking liquidity besides several other measures to mitigate the problem that is being faced because of the outbreak.

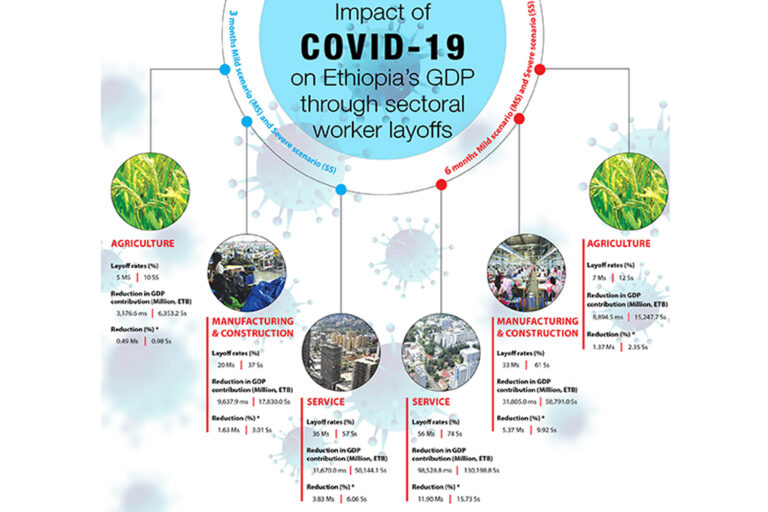

“Under different scenarios for labour layoffs and pandemic duration, our results indicate that the pandemic will reduce Ethiopia’s economic growth in the range of 2.2 percent to 9.9 percent in 2020,” the paper written by Degye Goshu, Tadele Ferede, Getachew Diriba, and Mengistu Ketema stated.

It further indicated that in a very conservative scenario (mild scenario) with three months pandemic duration, economic growth will be reduced by over two percentage points from the base due to labor reduction either temporarily or permanently.

“Even under the mild scenario, delays in the containment of the virus will lead to a large reduction in economic growth which could multiply the economic cost of the disease,” it added.

The poverty impact of the pandemic is considerable due to a slowdown in economic activity, “incidence of poverty is expected to worsen, especially in the severe scenario, as nearly half of the population would fall into extreme poverty under acute and protracted economic downturn and prolonged pandemic duration,” it said.

At national level, the incidence of poverty is expected to grow from 22.1 in the base scenario to 38.4 percent in the worst scenario, suggesting that nearly half of the population will fall under extreme poverty if the pandemic lasts for a year.

The paper stated the pandemic will have differentiated impact on rural and urban areas, added that the effect in service and industry sector will be more serious than agriculture sector.

“The pandemic is expected to hit hard the service sector. The industry sector, especially labor-intensive manufacturing industries will be impacted by the pandemic. If the pandemic lasts for a longer period, the agriculture sector will also be negatively affected,” it stated.

The incidence of poverty will increase by about twofold with significant variation across rural and urban residents. Similarly, the depth of absolute poverty will increase from 6 percent in the base scenario to 12 percent (double) in the extreme scenario.

Concerning expression of value it stated that under the mild scenario and three months duration, the economy will experience a loss of around 44.5 billion birr or 2.2 percent of GDP compared to the baseline, with the service sector experiencing a large contraction of 3.8 percent.

“However, under prolonged duration where the pandemic is mild, the economy will experience a significant loss, amounting 139.2 billion birr or 6.7 percent loss in GDP relative to the base case. The services and manufacturing sectors will be hit very hard if the pandemic lasts for six months,” it added.

Further more if the pandemic continues for three months under the assumption of severe scenario, about 3.6 percent of total GDP contribution from labor productivity will be lost. This means, more than 74 billion birr will be lost within three months.

“Under this scenario, the effect of the COVID-19 on the service sector in terms of reducing GDP is very high (reduction of about 6.1 percent of annual GDP within 3 months) followed by that of manufacturing and construction (reduction of about 3 percent), and agriculture (reduction of about 1 percent),” it elaborates the estimation.

“However, if the pandemic lasts for 6 months, about 9.9 percent of total GDP will be lost under the severe scenario. That means, the country is going to lose more than 204 billion birr within six months,” stating the worst case scenario.

The effect of COVID-19 on the service sector in terms of reducing GDP is very high (reduction of 15.7 percent of annual GDP within 6 months) followed by that of manufacturing and construction (reduction of about 9.9 percent), and agriculture (reduction of about 2.4 percent).

The paper that support the current government’s decision to limit mass transport, ban gatherings, business closure, flight bans, school closure, and work- from- home may be feasible measures for certain segments of the Ethiopian population under specific context.

“For the vast majority, movement restriction will not be feasible. It is important, also, to explicitly clarify, in no uncertain terms, that ‘mass transport ban’ does not and should not include national and regional supply chain and logistics networks in order to avoid the disruption to the national supply chain. This is a crucially important clarification as a matter of national security agenda,” it added.

The study has also added that due to less room numbers on household level, isolation at home is not feasible in both rural and urban areas to control the pandemic.

“The most relevant and feasible option to control the pandemic in Ethiopia is to limit the spread of the pandemic, not isolation after spread,” it added.

According to the latest policy paper of the Ethiopian Economics Association the feasibility of quarantines is also dependent on the country’s health facilities and supplies, health professionals, population size, and nature of the pandemic.

Layoff

The paper has also clearly stated the wave of the layoff and the effect in the economy. The policy paper stated that the magnitude of job loss depends on the length of the pandemic.

For instance, about 37 and 61 percent of jobs will be lost in the manufacturing and construction sectors in the three months and 6 months severe scenarios respectively. The services sector will be severely hit, as it would experience a decline in employment by 57 and 74 percent in the two scenarios respectively.

Recommendations

The paper recommended that NBE shall initiate discussions to reduce interest rates to stimulate the economy and initiate discussions with financial institutions to support exporters by increasing foreign trade credits, deferring loan payments and extend debt rollovers.

It added that NBE needs to consider reserve rate relaxation to enhance banking liquidity and discuss with commercial banks on rescheduling bank loan repayments and write off interest payments for severely affected sectors until the shock is abated.

“Put in place alternative mechanism to fill a potential import deficit. These may include planting short-season and early-maturing crop varieties and prioritizing irrigation schemes for selected foods crops (e.g. potato, maize, etc.),” it added.

The 46 pages policy working paper concludes its recommendation stating that the pandemic sends a message that there is a need to establish a national Sovereign Fund that will be activated and deployed in times of crisis and acute emergency situations.

A sovereign fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity fund or hedge funds.

Quantity of products entering ECX increases

The products entering the warehouses of the modern trading platform Ethiopian Commodity Exchange (ECX) has increased in the last couple of weeks, Capital learned.

Experts who observed the trading activity at ECX told Capital that the product that ECX is trading has shown increment in the past few weeks.

Wondimagegnehu Negera, CEO of ECX, confirmed that the arrival commodities at ECX warehouses increased. But he said that it is not that much exaggerated meanwhile the production arrival at the warehouse increased.

Experts said that tight control on contraband and the recent implementation of strict border control and closure to control the COVID 19 outbreak might have effect to increase the arrival of the product to the legal market.

Three weeks ago Prime Minister Abiy Ahmed announced the closure of all border outlets except for logistics to control the global pandemic.

Wondimagegnehu more or less accepted the speculation that the border closure might help increase product arrival at the warehouse. “Tight control and the recent decision might have the effect on the increment of the product to the legal trading floor,” he said.

He also estimated that speculations might have effect on the increment of the product for the trading centre. a

“At the beginning of the outbreak in China the demand for commodities declined and due to that some of the speculation mismatch with the situation that might be the reason for the increase of the arrival of commodities at the trading warehouse,” the CEO said.

One of the exporters of sesame seeds and pulses told Capital that the market has been affected in the past few months on two products particularly in relation with the closure of China due to the pandemic.

“Now things are improving in the Far East country,” a representative at one of the exporting company, who asked for anonymity, told Capital.

He said that there was shortage on some of the products at the trading floor that it hopes things might be improved in the coming days.

In related development, the exchange has announced that it has taken firm measures to downsize the number of traders at the trading centers.

Netsanet Tesfaye, Public Relation Head at ECX, told Capital that since the outbreak was confirmed in the country the trading floor has applied several changes on the electronic trade.

He said that a representative of the companies that attend the trading has dropped to one for one company; in the past more than one representative shall attend the daily trade.

“For trading of pulses and oilseeds which is usually held every morning, the number of attendants from both sellers and buyers is reduced by half and the balance number will attend the other day trade,” Netsanet says “we make it the trading of one company in every other day classifying them on alphabetical order.”

According to the Public Relations Head, the coffee trading, which is usually held every afternoon to fit with the trading time of New York, attendants have also classified in to two and traders will attend the trading every other day besides reducing the number of representative of companies to one.

He said currently the flow of product to ECX warehouse is being undertaken as usual. “Even some of the products has shown increment meanwhile it is difficult to understand the reason,” he added.

The trading floor has also divided its staffs into two and every other week one of the two staff of group leave the office.

“We will continue our trading since it is the motor of the country’s economy and the hard currency source,” “I assure you we will be the last if the government ordered forced total locked down in the country,” he confidently disclosed that the trading floor will not suspend its operation until the last minute.

Currently ECX has two actual electronic trading platforms in Hawassa and Hummera besides the centre at its head quarter in Addis Ababa.

Netsanet disclosed that the Nekempt trading floor will commence operation when the situation around there is solved.

He added that stiff safety measures are also been taken at the ECX branches to keep the safety of daily laborers and others coming to the branches.

Currently ECX is exclusively trading coffee, sesame, red kidney bean, white pea bean, mung bean and soybean.

In the 21 trading days of March, ECX has facilitated the trading of 3.84 billion birr worth of 75,000 tons of commodities.

From the stated value and volume, the coffee trading has taken 63 percent and 40 percent respectively. Compared with the same period of last year the value has climbed by 24 percent, even though the value shows a two percent drop.

Different global market figures indicated that the price of coffee has shown increment at the same time the demand surged.

Government announce interest to buy high volume basic commodities

Ministry of Trade and Industry (MoTI) invited foreign traders to import a given amount of basic commodity by using their own foreign currency. The latest expression of interest (EOI) stated the volume of the products that the government wanted to be imported by overseas companies.

On the expression of interest issued on April 8 the ministry expressed its interest to import 18.1 million quintal of wheat, 1.73 million quintal of rice, 104.3 million liters of edible oil, and 3.2 million quintal of sugar.

It has been recalled that the Ministry of Finance invited interested suppliers for basic commodities that can import using their own foreign currency that will be paid within two years period.

Experts said that the current expression of interest document is different because it states the volume that the government wants to import.

Experts on the sector said that in the previous call issued by Ministry of Finance the government called suppliers to show their capacity than indicating its demand.

Experts say that the time is difficult to get basic commodities since the coronavirus pandemic challenges countries and their economy all over the world.

The International Grain Council expects a sharp upturn in near-term demand for rice and wheat-based foods.

They said that the price of basic commodities is rising; rice, which surge on higher level in seven year and wheat price has increased by 15 percent in second half of March.

The Ministry of Trade and Industry EOI which is open to all overseas companies who meet the criteria indicated that the purpose is to solicit applications and short list multinational companies to supply the basic food commodities and/or industrial inputs to the Ethiopian market.

According to some of the criteria stated, the shortlisted companies shall agree either to invest, which might be partially, or repatriate the cost incurred for importation of basic food commodities together with the margin above two years from the date of import.

The summation of EOI will be close on April 23.

Experts on the sector told Capital that they have doubts about the fruitfulness of the EOI. They argued that two years for repatriation is not feasible as a business.

Companies want to transact the money they invested more than one, while the current interest of the government, the money will be idle for two years that could not be accepted by any manner and shall be affected by global price hike or inflation.

Previously the State Minister of Finance Eyob Tekalegn, told Capital that there are companies coming to involve on the new scheme.

He ridiculed the argument of some experts that the government might not get companies to be involved on such kind of scheme.

“We have got several interested overseas companies to get on the business,” he told Capital few weeks back.

The government is getting on this new trend considering to tackle basic commodity supply shortage, fight the inflation and access fresh hard currency, that is short for the country.

Currently, only Ethiopians and the diaspora are legally allowed to involve on the retail or wholesale business in the country.

Meanwhile on its way to be member of World Trade Organization and Continental Free Trade Agreement Ethiopia is expected to easy such restrictions for foreign companies.

The government is the major importer of wheat at a cost of close to USD one billion every year. According to experts, the volume of wheat stated on the EOI shall cover the demand for about one and half year.

Edible oil is also mainly imported by the government even though there are over two private and political party affiliate companies that are allowed to import the product.

At the same time import of sugar is monopolized by the government so far. But the policy and regulation of sugar that is coming following the decision to privatize some sugar millers drafted the importation of the sweat by private operators who will buy the factories.