The Commercial Bank of Ethiopia (CBE), a state-owned financial institution, has adjusted its credit interest rates, a decision that has incited criticism from industry stakeholders. Critics argue that the bank is misunderstanding its responsibility to protect the nation’s economic stability. Simultaneously, CBE has expanded its range of loan offerings.

Earlier this week, CBE announced the adjustment of its loan interest rates, marking the first revision in four years.

The new rates, which took effect on Friday, March 7, apply to nearly all loan categories except for agriculture and housing. In its announcement, CBE attributed this change to the government’s initiative to foster greater economic competition.

“The financial sector is undergoing significant transformations,” the bank stated, explaining that the interest rate adjustments are based on the principles of supply and demand.

CBE also emphasized its commitment to implementing transformative strategies aimed at enhancing competitiveness and introducing new loan products.

However, the bank recognized that the cost of attracting deposits remains high, despite reductions in operational expenses due to ongoing reforms.

The rising cost of deposit mobilization, combined with loan interest rates that are lower than the market average, has adversely impacted the bank’s profitability.

This decision has elicited mixed reactions from experts. Some contend that as a policy-driven institution, CBE should prioritize its role in stabilizing the national economy rather than emulating private banks.

Conversely, others suggest that the decision’s impact will be minimal. “Given the limited availability of loans, the adverse effects are likely to be negligible,” one expert noted.

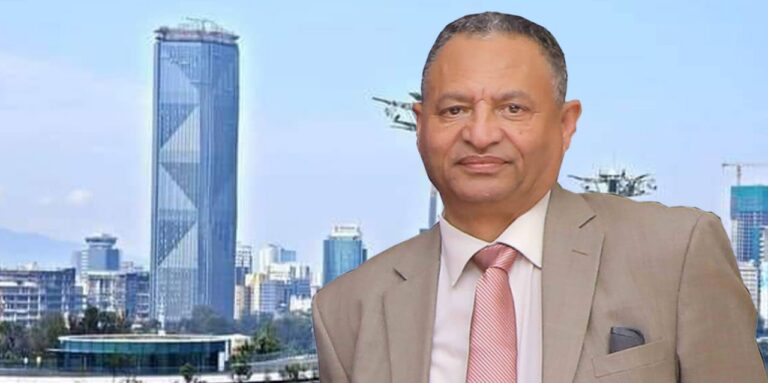

Eshetu Fantaye, a former executive at several banks, speculated that CBE’s move might prompt private banks to further increase their loan interest rates.

However, Eshetu, along with other experts, including current and former bank executives who requested anonymity, criticized CBE’s decision.

A senior banking official pointed out that CBE benefits from various policy protections that insulate it from competition with private banks.

“Numerous regulations do not apply to CBE, allowing the state bank to dominate the market without facing competitive pressures,” the official told Capital.

A former bank executive with extensive experience in both state-owned and private financial institutions echoed this sentiment. He asserted that CBE’s ability to attract funds is more efficient and less costly compared to private banks, which struggle to expand their deposit bases.

“Private banks are offering over 16% for fixed deposits, while CBE’s resources primarily come from public enterprises, government offices, and major public transactions,” he explained.

He cited petroleum transactions as an example, noting that they are processed exclusively through CBE and Telebirr, which ensures that all funds are directed to the state bank.

The former executive dismissed CBE’s claims of high fund mobilization costs as unjustified, arguing that such policies disadvantage private banks, particularly those providing essential working capital for sectors like fuel distribution.

He also cautioned that adjusting interest rates would likely increase market prices more than it would benefit borrowers, ultimately placing a greater burden on consumers. In advanced economies, similar measures are often implemented to curb inflation by discouraging borrowing at high rates.

However, he pointed out that this strategy may not be effective in Ethiopia, where demand for loans significantly exceeds supply, and basic goods remain scarce.

Experts emphasized that although CBE is a state-owned institution, it should still operate competitively within a free-market economy.

“A separate matter that needs resolution with the government arises if the reforms aim to address issues stemming from government interference,” remarked a sector analyst.

The analyst emphasized the significant loans that the government has taken from CBE, totaling hundreds of billions of birr.

“I don’t oppose the government borrowing from the policy bank to support development initiatives, but such borrowing must be managed wisely,” he told Capital.

The primary goal of a policy bank should be to stabilize the economy and promote growth, unlike private banks, which prioritize profitability.

“I expect the policy bank to concentrate on key sectors that drive national development and economic stability,” stated a banking professional.

He argued that merely increasing revenue would not make the bank more efficient. “CBE needs to overhaul its internal processes to enhance competitiveness and improve profitability,” he said.

Some business leaders who spoke with Capital expressed concerns that CBE’s decisions might deter borrowing. However, financial experts countered that the current shortage of loan supply undermines these worries.

“Such measures might be effective in more developed economies, but in Ethiopia, the imbalance between loan demand and supply makes them less impactful,” experts noted. “The market continues to experience shortages of essential goods.”

In terms of loan diversification, CBE has introduced new offerings, including mortgages, vehicle loans, and personal loans. Experts welcomed this development, noting that consumer loans, including mortgages, currently make up a small portion of banks’ lending portfolios.

“Banks primarily lend to economically active sectors, particularly trade. This new initiative is a step in the right direction, although it comes with some caveats,” said a former banking executive.

Eshetu Fantaye, now a consultant for various domestic and international organizations, observed that CBE’s rate increases are relatively modest compared to those of private banks. He recognized the overwhelming demand for loans, regardless of interest rates, and highlighted the ongoing challenge of limited loan availability.

He agreed that CBE’s cost of funds is significantly lower than that of private banks. “When I was at CBE, the cost of funds relative to inflation was no more than six percent. However, current expenditures on staffing, office rentals, and general overheads have risen,” Eshetu noted.

He told Capital that neither CBE nor other banks should maintain interest rates at their current levels, given the existing cost of funds. “Their systems are outdated and need modernization,” he added.

Eshetu estimated that, in Ethiopia’s current economic climate, loan interest rates should not exceed 15%. “Most banks rely heavily on savings, which average around eight percent, but the profit margins on loans are excessively wide,” he explained.

He predicted that CBE’s decision would lead private banks, particularly mid-sized ones, to adjust their interest rates again within a few months. “I don’t expect larger banks to follow suit, as their dividend payouts exceeded 25% in the last fiscal year,” he added.

He pointed out that the primary drivers of inflation at this stage are the interplay of market demand and pricing trends, both domestically and in neighboring countries, which are purchasing Ethiopian agricultural goods at higher prices.

Additional factors include rising costs for inputs due to currency devaluation, limited capacity to produce enough essential goods locally, and a persistent shortage of foreign exchange.

“Given these circumstances, the rise in loan interest rates will only have a marginal effect,” he clarified. Nevertheless, he stressed that excessively high interest rates, which could constrain loan supply, would pose a more significant risk to the economy.