The majority of Airbus sites in Spain have joined forces to produce 3D printed visor frames, providing healthcare personnel with individual protection equipment in the fight against Covid-19.

More than twenty 3D printers are working day and night. Hundreds of visors have already been produced and dispatched to hospitals close to the Airbus facilities in Spain. Airbus leverages a patented design to manufacture the visor frames, using PLA plastics.

“One of the reasons I love my job is the capability we have for advanced design and quick manufacture. Overnight, we have gone from making aerospace concepts to medical equipment. This genuinely makes a difference in the fight against the pandemic and I couldn’t be prouder of our teams working day and night on this Airbus project,” said Alvaro Jara, Head of Airbus Protospace, in Getafe, Madrid.

Despite the pause of the majority of production at Airbus’ sites in Spain following the Royal Decree of 29 March, Airbus employees are allowed on site to continue with this essential activity.

In addition, Airbus in Germany also joined the project. The Airbus Protospace Germany and the Airbus Composite Technology Centre (CTC) in Stade, together with the 3D-printing network named “Mobility goes Additive,” are now supporting this project in Spain, also coordinating the collection and transport of visors to the Madrid region.

Airbus to produce 3D-printed hospital visors in fight against Covid19

African finance ministers: urgent need for $100bn immediate emergency financing for COVID-19

African Ministers of Finance held a second virtual meeting, against the backdrop of rising COVID-19 cases in Africa. The meeting was hosted by Vera Songwe, Executive Secretary of the Economic Commission for Africa, and co-chaired by Ministers Tito Mboweni of South Africa and Ken Ofori-Atta of Ghana.

Countries shared their experiences and also discussed opportunities for mutual support. While acknowledging the commendable policy measures taken by governments, the Ministers underscored that Africa’s economy is facing a deep and synchronized slow down and could take up to three years to turn the corner.

They stressed the need to take “all possible actions to slow down and bring the spread of COVID19 under control in the short term but acknowledged this is an uphill battle.

The Coronavirus And Globalization

With more than 400,000 confirmed cases of COVID-19, businesses are coping with lost revenue and disrupted supply chains as factory shutdowns and quarantine measures spread across the globe, restricting movement and business activity. This pandemic is sending ripples around the world. As the world grapples with the coronavirus, the economic impact is mounting – with the G20 Finance Ministers and Central Bank Governors having a conference call on 23 March to discuss how to address the emergency.

The International Monetary Fund’s Managing Director Kristalina Georgieva issued a statement following the call, in which she outlined the outlook for global growth: “For 2020 it is negative – a recession at least as bad as during the global financial crisis or worse.” But she added: “We expect recovery in 2021. To get there, it is paramount to prioritize containment and strengthen health systems – everywhere.”

The Organisation for Economic Co-operation and Development warned on 23 March that the shock from the virus is already bigger than the global financial crisis. OECD secretary general Angel Gurria said many countries would fall into recession and countries would be dealing with the economic fallout of the COVID-19 pandemic for years to come. “Even if you don’t get a worldwide recession, you’re going to get either no growth or negative growth in many of the economies of the world, including some of the larger ones, and therefore you’re going to get not only low growth this year, but also it’s going to take longer to pick up in the in the future”, he stated. This statement comes after the United Nations Conference on Trade and Development, the UN trade agency, warned of a slowdown of global growth to under 2% this year, effectively wiping $1 trillion off the value of the world economy.

Economic slump is wildly predicted for China. China is the world’s second-largest economy and leading trading nation, so economic fallout from this former COVID-19 epicentre will be critical to watch. Economists polled by Reuters on March 3-5 said the outbreak likely halved China’s economic growth in the current quarter compared with the previous three months.

The poll of more than 40 economists, based both in and outside mainland China, forecast growth to fall to a median of 3.5% this quarter from 6.0% in the fourth quarter of 2019, a full percentage point lower than predicted in a February 14 poll. “If you’re in a city which has been basically closed down or put under virtual house arrest, you’re not going to go out to the streets, you can’t go to the cinema, the restaurants…with all those sorts of things, economic activity will be substantially negatively affected,” said Rob Carnell, head of Asia-Pacific research at ING.

According to Rob Carnell, the Chinese economy is likely to be hit further by reduced global demand for its products due to the effect of the outbreak on economies around the world. Data released on 16 March showed China’s factory production plunged at the sharpest pace in three decades in the first two months of the year, something which could mean an even greater economic slowdown than predicted in that poll. “Judging by the data, the shock to China’s economic activity from the coronavirus epidemic is greater than the (2008) global financial crisis. These data suggest a small contraction in the first-quarter economy is a high probability event. Government policies would need to be focused on preventing large-scale bankruptcies and unemployment” said Zhang Yi, Chief economist at Zhonghai Shengrong Capital Management.

In a frantic bid to address the impact, United States Senate passes historic $2 trillion rescue package. So far, more than 3 million Americans filed unemployment claims last week. UK to pay up to 80% of employee wages for those unable to work due to the pandemic. The European Central Bank to launch €750 billion stimulus program, following US Federal Reserve move to cut interest rates to nearly zero. The coronavirus and the efforts underway to control its effects are literally bringing much of the world to a standstill. That standstill entails tremendous risks. What the coronavirus has not done, however, is to put in train a process of deglobalization. This has already happened earlier, in the reaction to the 2008 global financial crisis and what came in its wake.

The pandemic of COVID-19 is the third great shock of this still relatively new century. But COVID-19, the contagion which is so widespread largely because of human hyper-interconnectivity on a regional and global scale, is dramatically accelerating this process. Borders, on land, at sea and in the air, are staging a comeback, sometimes unilaterally, even in the EU. The COVID-19 crisis has become the third great shock of the century, after the 9/11 attacks in 2001 and the process unleashed by the fall of Lehman Brothers in September 2008, which triggered economic and financial contagion.

To combat the economic fallout, the United States Federal Reserve on 15 March cut its key interest rate to near zero. But the move, coordinated with central banks in Japan, Australia and New Zealand in a joint-effort not seen since the 2008 financial crisis, failed to shore up global investor sentiment, with oil prices dipping below $30 a barrel on 16 March, and a 9% slump in share values when Wall Street opened.

China is the world’s biggest oil importer. With coronavirus hitting manufacturing and travel, the International Energy Agency (IEA) predicted the first drop in global oil demand in a decade. On 9 March, oil prices lost as much as a third of their value – the biggest daily rout since the 1991 Gulf War, as Saudi Arabia and Russia signaled they would hike output in a market already awash with crude, after their three-year supply pact collapsed. Anyone hoping cryptocurrencies might prove a safe haven was disappointed. Bitcoin lost more than 30% of its value in the five days to 12 March, Reuters reported, outpacing losses for stocks and oil. Meanwhile, the European Central Bank (ECB) also took action, launching on 18 March a €750 billion Pandemic Emergency Purchase Programme that is expected to last until the end of this year.

On 20 March, the UK announced radical fiscal spending measures to counter the economic impact of a worsening crisis. The government said it would pay up to 80% of the wages of employees across the country unable to work, as most businesses shut their doors to help fight the spread of coronavirus. Earlier in the month, the Danish government announced it would help private companies struggling to manage the fallout from the pandemic by covering 75% of employees’ salaries, if firms agreed not to cut staff.

Meanwhile, the United States Senate on 25 March approved an unprecedented $2 trillion stimulus plan, including direct payouts to millions of Americans. The House of Representatives is expected to pass the rescue package on Friday. The bipartisan deal was announced as the Labor Department released statistics showing more than 3 million people last week filed for unemployment benefits in the US – the most ever in a week.

On 5 March – before the United States travel ban was announced – the International Air Transport Association (IATA) predictied the COVID-19 outbreak could cost airlines $113 billion in lost revenue as fewer people take flights. “The industry remains very fragile,” Brian Pearce, the IATA’s chief economist, told the Associated Press. “There are lots of airlines that have got relatively narrow profit margins and lots of debt and this could send some into a very difficult situation.”

On March 16, British Airways said it would cut flying capacity by at least 75% in April and May. Other UK airlines, including Virgin Atlantic and easyJet also announced drastic cuts. The travel and tourism industries were hit early on by economic disruption from the outbreak. Besides the impact on airlines, the UN’s International Civil Aviation Organization (ICAO) forecast that Japan could lose $1.29 billion of tourism revenue in the first quarter due to the drop in Chinese travellers, while Thailand could lose $1.15 billion.

To be continued ……

Online delivery

ETTA Solutions PLC (ETTA) assigned thousands of motor bikes to expand its Z Mall delivery service around the city. Z Mall was introduced eight months ago and facilitates a modern app to connect customers with service or product suppliers. Currently the platform formed under ETTA connects some food chains and supermarkets like Pizza Hut and Shoa and Abadir Supermarkets with their customers.

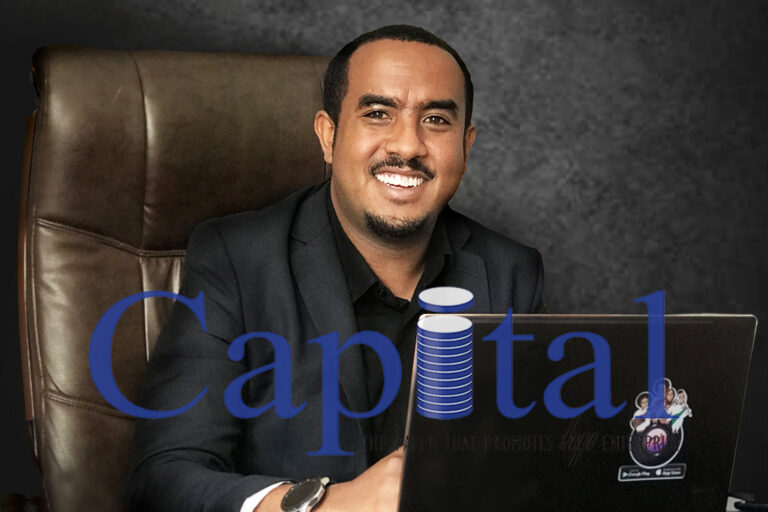

Using the app customers can order any service from the providers and the delivery will be delivered by motor bikes. During these tough times online delivery is the best way to avoid contact with customers at stores and will help fight the virus by helping you to stay at home with convenience. Temesgen Geberehiwot, Managing Director and Founder of ETTA, talked to Capital about the activities of Z Mall. Excerpts;

Capital: What is the activity of z mall? Please elaborate the app of zmall?

Temesgen Geberehiwot: ZMall is an e commerce and delivery platform. We offer a wide range of merchants through our service, including supermarkets like Shoa Supermarket, Bambis supermarket , Fresh Corner and Abadir Supermarket, restaurants such as Pizza Hut, Savor, Mama’s kitchen and Village and beverage products such as BGI’s Products, Dieago’s Product and beauty supplies such as Jordan Beauty Supply and many more. All delivered to our customers in about 30 minutes. The app is called ZMall that’s available for iOS and Android as well as a website called ZMallShop.com to accommodate our wide range of customers. We accept any vendors as well.

We call our app Ethiopia’s Online Marketplace because very soon we will have online stores for all of your favorite services and products from throughout Ethiopia, which will be easily delivered directly to your home. Convenience and safety are the two key selling points of our service.

ZMall is a product of ETTA Solutions PLC, which is a tech company founded by me and my partner Ambaye Michael Tesfay launched in 2016. We have thus far independently financed and managed this company while also creating other services such as ETTA Taxi, Shekla Musicand our fast growing Enterprise resource planning system (ERP).

But we are now focusing a majority of our effort on growing ZMall right now because it is an essential service at such an uncertain time. We want to be able to flatten the curve by helping people stay home and taking care of all their shopping needs.

Capital: When did you commence your operation?

Temesgen Geberehiwot: We started our operation about 8 months ago, with our first partner Pizza Hut’s food being our main delivery. We have slowly expanded since then and find ourselves with about 20 current vendors, with another 50 or so vendors who will be coming from aboard in the next few weeks. We are targeting to have over 700 vendors on our platform by the end of 2020.

Capital: How many motor bicycles do you operate now and what makes your operation unique?

Temesgen Geberehiwot: We currently have 50 motorbikes in service, but we have a very aggressive growth plan for our fleet. Our current model was simply one in which the company own the motorcycles and hire drivers to work within our system, but we are in the process of shifting towards a model that empowers youth by partnering up with local banks and finance institutions and offering young men and women all around Addis the chance to finance a brand new motorbike for themselves, while being giving them guaranteed income as a ZMall driver. Even at current levels, our drivers are getting good income and we also offer work based incentive. We want to motivate our youth to work hard and make money in our service and our intended target is 7800 new jobs created by the end of 2020.

One of the core beliefs of our company is that we can use technology as a tool to uplift our community and help people provide financial stability for themselves and their families. We are certain that the Ethiopian youth are ready to embrace the digital economy.

Capital: Is your service is affordable for ordinary citizen?

Temesgen Geberehiwot: We are always working hard towards making our service affordable to any and every citizen.

For example, in association with our partners at Jupiter Hotel, we have made available the 150 birr lunch special available anywhere in Addis. This means a quality meal produced by the high class facilities at Jupiter Hotel, delivered anywhere in Addis Ababa for only 150 birr (the price includes delivery fee). Both Jupiter and ZMall slashed all of our profits and are operating at cost on this service because we are not doing it to make money, rather than to encourage people to stay at home. We will be doing several other specials like this so that people from all income brackets can find what they are looking for on ZMall.

Capital: How many customers/service providers do you have now?

Temesgen Geberehiwot: We currently have about 15 thousand plus active clients and we have processed more than 45 thousand deliveries thus far.

Capital: How is the growing interest of service providers?

Temesgen Geberehiwot: Once service providers hear of the impact that ZMall has on their service, they are instantly hooked. And it’s not just the additional income we offer, but also the seamless technology we offer them to handle their orders. We give them their own app to manage their store that conveniently lets them update and manage their stores. We also offer our ERP services to quite a few of our vendors, so what we are selling them is the full convenience package; which is additional volume for your service and an easier way to manage it.

Capital: As you know the covid 19 virus forced the public to stay at home; at the same time consumers should have to go to shop but the government recommends to stay at home. How do you serve the public during this difficult times?

Temesgen Geberehiwot: This is where we believe our service should step up and serve our community. Social distancing and staying home is a very important thing at this stage of the pandemic so we want people to use our service as an alternative from going to the store or market, which is a daily chore for many families around the city.

Our staff takes all necessary safety precautions, because our customers’ safety is our top priority. We have a very rigid twice daily washing and sanitizing routine that all of our delivery people and facilities go through at our headquarters. We give our drivers updated trainings every day about COVID 19 and how to protect themselves and our customers. We also require our drivers and service providers to wear a mask and glove when handling your order. We also update our customers regularly on what further steps we are taking to protect them from COVID 19. We know how important a service like ours can be at this point and we are very serious in handling our demand.

Capital: What is your observation about the demand to use your app in relation with the virus outbreak?

Temesgen Geberehiwot: We have seen a large jump in demand for our service in the past few weeks and we understand where that is coming from. We have been preparing our internal staff and team to scale up for quite some time now as we had planned to prepare to aggressively expand our services since before this pandemic even came around. And now that it’s here, we are preparing our team to be able to handle whatever amount of workload is brought to us. We are also trying to work with the government in helping mobilise resources to different places.

Capital: What is your recommendation for the public and service providers during these hard times?

Temesgen Geberehiwot: Without being biased, my recommendation for service providers for now would be to temporarily shut down all their physical stores and switch to online selling of their products. Service providers still have the pressure of conducting service and paying employees on their shoulders, and by easily shifting to a model in which you are using a seamless online store that offers cashless transactions with Dashen Bank’s Amole app would be the way to go as our country moves towards stronger precautions against COVID 19.