The export of flower flourishes in the first half of the budget year by achieving 183 percent of the target, while the export sector is still going under target.

In the first half of the budget year the country earned USD 1.33 billion achieving 80 percent of the target for the stated period.

Meanwhile the achievement is lower than the target it has shown 10 percent increment compared with the same period of last budget year.

According to the report from the Ministry of Trade and Industry (MoTI), few sectors achieve more than the target set at the beginning of the budget year, but the major export items did not achieve the target.

The biggest achievement secured in the stated period compared with the projection was from the flower sector, which is included as one of the major items about a decade and half ago.

The six month report indicated that the ministry expected to get USD 123 million from flower export but the actual performance was USD 225.3, an increment of USD 102 million. The first six months achievement compared with the 2018/19 first half year has stood over double and up by 113 percent. Regarding the export items rank flower sector moved to the second place.

Wondimu Filate, Public Relation head of MoTI said that the high performance on the flower sector is the expansion of flower farms and solutions regarding instability in the area that allowed getting ample labour.

The other sector that is included in the horticulture investment sector, fruit and vegetable, achieved a 122 percent target.

According to the six months report of MoTI, the fruit and vegetable sector contributed USD 51 million, while the target was USD 41 million. However the fruit and vegetable sector earnings climbed significantly the volume stood at 76 percent of the target.

Khat that is one of the major hard currency earnings for the country has also stood at third level by earnings for the stated period but it has surpassed the projection.

The report indicated that khat earnings have reached at USD 174 million with 106 percent of the target. The achievement put the khat sector the third major hard currency source for the country.

Wondimu indicated that alleviation of contraband has contributed for higher performance.

The textile sector has also registered better performance compared with the performance a year ago. According to the six month report textile and garment sector contributes close to USD 100 million that is 86 percent of the target and 45 percent higher than last year performance.

Contrary the oil seed sector that was the second hard currency earning sector for the country decreased significantly.

In the first half of the budget year the oil seed sector that is mainly influenced by sesame seeds has contributed USD 108 million that is 61 percent of the target and 28 percent lower than the same period of last year.

“In relation with the new directive to cut under invoicing, farmers have been misinformed by suppliers and suppliers hoard the seeds,” the Public Relation head said. He said that ample seed was not supplied at the Ethiopian Commodity Exchange trading floor in the period that contributed for weak performance.

The mining sector mainly the gold export has also dropped compared with the same period of last year.

The report indicated that in the stated period the hard currency earning secured from gold is USD 13.5 million that is 20 percent of the target and over 30 percent lower than last year performance.

The leather sector, which is one of the country’s historical hard currency earnings shows a 27 percent decrease compared with the past year similar period performance and only generate USD 49 million.

The pulse sector at the same time reduced by 14 percent compared with the same period of last year. In the six months the pulse sector contributes USD 95 million that is 72 percent of the target.

Coffee, the major export item of Ethiopia, has contributed USD 365 million in the stated period. Despite showing an increment of nine percent compared with last year performance its achievement is 79 percent of the target.

MoTI report indicates that the volume of coffee exported in the period has surpassed the target and stood at 102 percent but the under invoice practice affects the earnings.

Contraband and some illegal acts including under invoicing and hoarding were stated as the major challenge for weak achievements on some sectors, according to the ministry.

Regarding destination Somalia retakes its top position by the share of 18 percent from the total export items followed by the Netherlands, which is the major destination for flower export.

From the total export the Netherlands and North America have taken 17 and 14 percent share and has stood at second and third. China that was the top export destination for the last two budget years replacing Somalia has stood at fourth rank.

The country has exported its products for 136 countries and agriculture sector earning led by USD 1.07 billion and followed by industry sector that contributes USD 221 million.

In the budget year the government has targeted to get USD 3.73 billion from export, which is fragile that did not show any sign of growth for the last nine years.

Half year export performance shows slight increment

IMF forecasts Ethiopia’s debt will decrease significantly

The International Monetary Fund (IMF) forecasts Ethiopia’s public debt will decrease significantly in the current budget year.

The IMF Article IV Consultation that evaluates Ethiopia’s economy indicated that the country public debt has dropped to 56.8 percent of the GDP in the past fiscal year from 59.5 percent a year ago.

“Policies appropriately targeted at containing public investment and debt contributed to a further narrowing of the current account deficit to 4.5 percent of GDP and a reduction in public and publicly-guaranteed debt to 57 percent of GDP,” the IMF statement stated.

The consultation forecasts that it will more minimize to 53.4 percent in the current budget year and further in the coming years.

It said that the external debt has declined to 28.2 percent in the 2018/19 budget year from 30.4 percent in 2017/18. The consultation has also forecasts the external debt shall drop slightly in the current budget year at stood at 28 percent but will grow in the coming years.

Moreover the domestic debt will significantly decrease in the coming years, according to the statement of IMF. The IMF Article IV Consultation indicated that the domestic debt has dropped to 28.6 percent and will be at 25.4 percent for this year. For the coming four years the domestic debt will be at 22.6, 19.1, 16.6 and 15.5 percentages respectively, according to the IMF forecasts.

The consultation also added that in 2018/19, real gross domestic product (GDP) is estimated to grow by 9 percent, driven by manufacturing and services. “However, performance of goods exports remained weak and foreign exchange shortages persist,” it added.

The statement forecasted that the macroeconomic policy measures envisaged under the Homegrown Economic Reform Plan to address external imbalances, debt vulnerabilities, and inflation are expected to contribute to a slower growth in real GDP of 6.2 percent in 2019/20.

According to IMF the country’s gross official reserves stood at USD 3.4 billion in the past budget year that is equal to 1.8 months of imports of goods and nonfactor services of the following year. For the current year the official reserves is expected to grown to USD 4 billion and will cover two months of imports of goods and services.

Regarding the growth of reserve the statement stated that it is due to higher external financing flows, including from the IMF.

The IMF forecasts that the country’s official reserve will achieve double digit by 2024 for the first time and will stand at USD 11.2 billion which will be equal to 4.3 months import.

According to the IMF document, the government revenue has dropped to 11.5 percent of the GDP in last year but expected to cope up slightly and will stand at 11.7 percent for this year and 13 percent in the coming year.

At the same time public investment shows reduction and will continue in its lower rate in the coming year. International partners including the IMF recommended that the government should improve the private sector activity.

According to the IMF Consultation the public investment was 11 percent in last budget year that was 12.6 percent in the 2017/18 budget year. The Consultation forecasts that it will stand at 10 percent for this year. However the private investment has registered significant increment and stood at 24.2 percent of the GDP for last year from 21.6 percent of a year ago.

The gross domestic saving reduced to 22.3 percent in last year from 24.1 percent of the GDP a year ago, is expected to expand to over 25 percent in this budget year and will continue its growth for the coming years.

The broad money also reduced to 19.7 percent in last year from 29.2 percent in the 2017/18 budget year. The IMF forecast indicates that the broad money will reduce to 18 percent for the current year. At the same time the base money has reduced to 15.3 percent for 2018/19 budget year from 19.1 percent a year ago and for the current year the base money will drop to 12.5 percent of the GDP.

IMF also stated in its statement that policies appropriately targeted at containing public investment and debt contributed to a further narrowing of the current account deficit.

Ethiopia’s GDP at current market prices will reach at about 3.4 trillion birr in the current budget year from 2.7 trillion birr last year.

“Over the medium term, macroeconomic and structural reforms announced by the authorities are expected to lead to a reduction in public debt, lower external vulnerabilities, and stronger growth, investment and exports,” IMF added in its latest statement.

It was recalled that after the conclusion of IMF team the annual Article IV Consultation the IMF Executive Board approved USD 2.9 billion on three-year arrangements under the Extended Credit Facility (ECF) and the Extended Fund Facility (EFF) for Ethiopia.

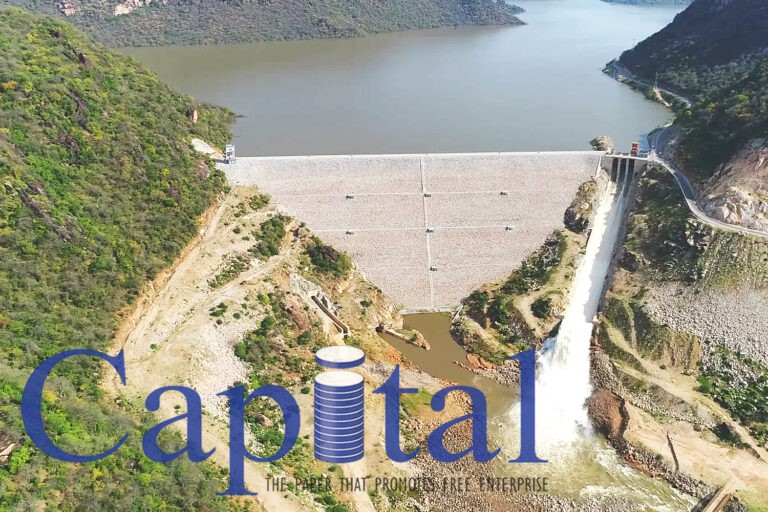

Genale Dawa III enters the national grid

The Ethiopian Electric Power /EEP/ announced that the construction of Genale Dawa III dam is completed and ready to start generating power after ten years of construction.

Genale Dawa III hydropower project launched in 2010, has the capacity to generate 254 MW with three turbines each with a generating capacity of 84.7 MW.

The dam is 110 meter high and 426 meter long and has the capacity to hold 2.5 billion cubic meters of water.

Out of the total cost of the project which is 451 million dollar, 40 percent of the finance is covered by the Ethiopian government and the rest 60 percent covered by a loan from the Chinese EXIM bank.

The construction of the dam was done by China Gezhouba Group /CGGC/.

The project which was started ten years ago was expected to be finalized within four years but was delayed because of resettlement issues near the dam according to Moges Mekonnen, corporate communication director of EEP.

Genale Dawa III hydropower project is located in the Southeast Ethiopia in Oromia regional state, 630 km from the capital.

The new dam is expected to increase the country’s generation capacity to 4,514MW from the current 4,260MW.

The energy sector is one of Ethiopia’s priorities as the country envisages becoming a light manufacturing hub in Africa together with a middle-income economy by 2025.

Ethiopia plans to increase its current electricity generation capacity to 17,300 MW by 2025, with power generation projects in hydro, wind, geothermal and biomass sectors.

Djiboutian business delegation keen on investment opportunities

A high level delegation comprised Djiboutian business community visits business destinations and potentials in Oromia region and formed a joint committee to solve problems.

The delegation that was led by Youssouf Mousa Dawaleh, President of the Chamber of Commerce of Djibouti (CCD) , visited industrial parks based in Oromia region and the Mojo Dry Port on its three days visit concluded by a discussion held on Saturday January 25 at Ethiopian Skylight Hotel.

Chaltu Sani, Vice President of Oromia region, who co-chaired the discussion with CCD president, said that the aim of the visit and discussion is to boost the relationship, investment and tackle contraband business that affects both sides.

It has been recalled that a delegation led by Shimelis Abdisa, Vice President of Oromia region, visited Djibouti in the second week of December, 2019 and the latest Djiboutian visit is the continuation of that by the invitation of the region leader, according to the CCD President.

“Our visit is to meet and discuss on several issues with the business community and authorities in the region. The very gist of the visit was seeing the way to strengths link between the two business communities in different areas,” Youssouf Mousa Dawaleh told Capital.

According to Youssouf Mousa, both sides have common interest and joint business development and the current visit shall put clear vision regarding that.

Several issues have been discussed mainly on the export of khat, fruits and vegetable and coffee.

“There are some members who were already ready to invest in several activities and we hope that we will conclude this with a permanent joint committee formed between the two sides,” Youssouf Mousa said.

Chaltu told Capital that Djibouti is the closest ally of Ethiopia and for the region specifically since most of the export commodities to Djibouti are produced in Oromia.

“The product of our farmers is exported to the country but with past bad practices in the region they are not getting adequate benefit compared with their production,” she said.

According to the Vice President, a study undertaken by the region indicated that the farmers were only benefiting 8 percent from the khat business, which indicates that how the contraband business damages both.

“The contraband was the major challenge for the area, however we have formed a joint committee that will tackle the problem,” she added.

Abdourahman Elmi Ismael, first secretary of CCD and chair of the joint committee formed by the two sides, said that the Ethiopian investment policy is improving these days.

Some of the Djiboutian investors, who are considered as Ethiopian national based on Ethiopian law, are already interested to invest in the region.

Abdourahman Elmi told Capital that the delegation actors expressed their interest to invest in Ethiopia.

“The Ethiopian law that considers Djiboutian as Ethiopian is something very important for Djiboutian but we have to develop that and encourage and inform people about that since most of our people don’t know that,” he added.

Payment issues for transit companies in Djibouti, export items quality were part of the concerns raised at the joint committee meeting that was held at the final day of the visit.